Vail Releases Metrics

12

12

HaHa! I did own some Berkshire Hathaway way back when, and even Bogle is now saying there is a place for actively managed funds. Of course index funds/ETF's are a good investment vehicle that are among my core holdings. However, I tend to invest back into my business. With that said, I'll be the first to admit that I'm not the best stock picker (think American Skiing Company, Continental Airlines, and a few others). |

|

Administrator

|

I'm not a stock picker at all. And I'd probably own all index funds if my 401k was with Vanguard.

But without active management the markets would not function.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

In reply to this post by Z

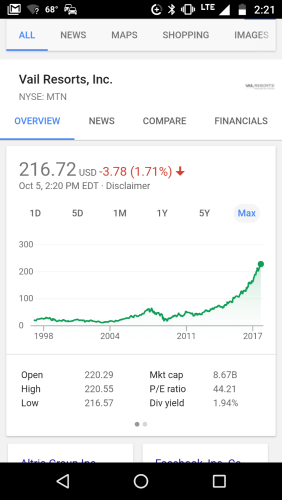

I'd be extremely worried about buying stock in any company whose chart looks like this:

Especially when one considers ASC, and other recent companies that fueled enormous expansions and acquisitions with debt ($1.27 Billion seems like a lot). |

Yeah, it's a bit of a gamble, but I have gains with other stocks to offset any losses, which is why I decided to load up on some more MTN. I'm still up a little over 40% since purchasing MTN. |

|

This stock is part of the divended growth section of the advisory service I use. That is the most conservative part. The chart can look like that when you are growing sales and earnings like Epic is by huge M&A activity that they are doing and still be conservative.

I'm up over 50% since buying this 6 months ago in it. As long as they keep buying resorts and have the cash flow to support that they will keep going up.

if You French Fry when you should Pizza you are going to have a bad time

|

|

In reply to this post by Rj1972

The only time I got into individual stocks was right around the end of the tech bubble, when I learned that I could do that in my IRA. Hey, times were rosy, everybody else was getting rich, why not, so, I allocated maybe ten grand as play money (like in A.C. or Vegas, accepting a big to total loss, although I'm no high roller in those places) and started buying. I fooled around a little, didn't do too bad, not really great, certainly didn't beat the market. But my biggest lesson was right after the tech crash, when I bought Apple at 18 bucks (yes, kiddies, it once was almost free) and sold at 28, thinking, ok, don't get greedy, as my old man used to say. I think those shares might be worth around a thousand today after the splits. Silly me.

funny like a clown

|

|

In reply to this post by MC2 5678F589

The whole market looks like that. Vail isn't really as indebted as ASC was. They're doing fine. Go to any Colorado Vail property. It's ridiculous how crowded, and, therefore, successful they are. They really have their finger on the pulse of the healthy 1% of America, Mexico and Latin America, and some Euro skiers, and deliver on what they want. You can look at that chart as a symbol of how well off the rich have been since the financial crash. I thought that the price of skiing out west would drop dramatically after the crash, but, nope, just the opposite out there. "Affordable" housing, constructed for employees in a public/private partnership, starts at about 400 grand in Frisco, down the road from Breck. It's ridiculous. I thought I could afford to retire there. Sheesh. So Benny just meets a woman he likes that skis. That's hard to find. But, she only likes to go to Vail twice a winter. Just Vail. Life is cruel, I tell ya, cruel. Cold and unforgiving.

funny like a clown

|

|

Administrator

|

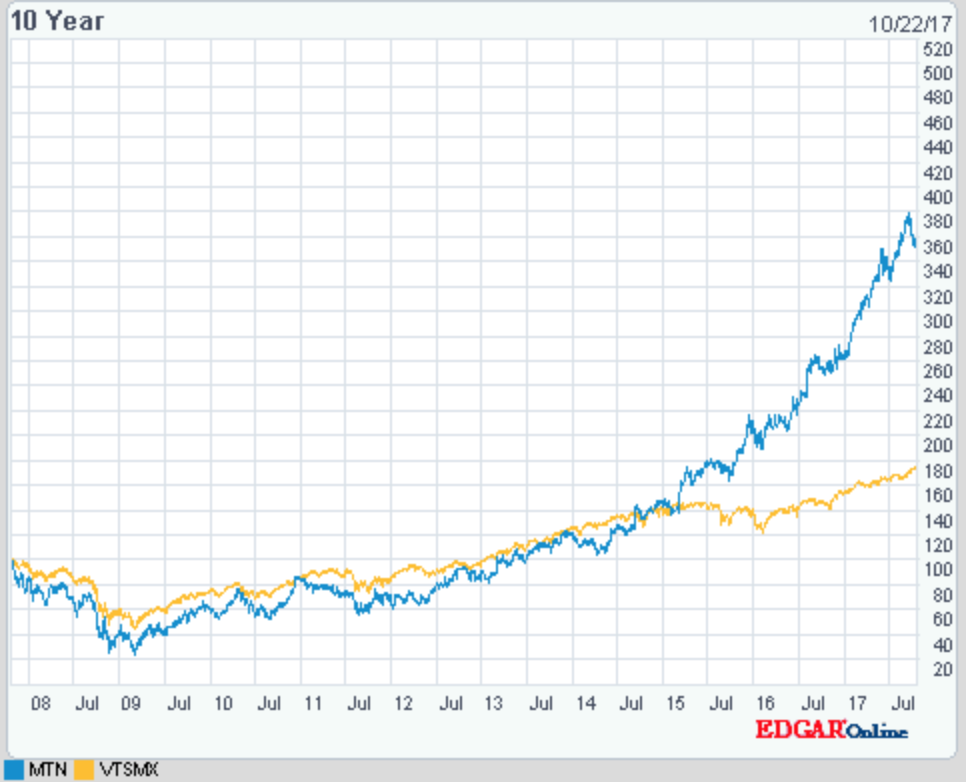

Here's Vail vs Vanguards Total Stock Market Index:

Go for it if you like to buy high. I'm playing the world's smallest violin for ya Benny. She's probably got some coin if she skis at Vail right?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

Seriously Benny......just take up tele.

|

|

In reply to this post by Harvey

Yeah, haha, I could use a sugar mama, for sure. But Vail. Lord. Fucking Vail. Aspen, even. I like Aspen. I could deal with that. She doesn't even go over to Beaver Creek. Jeez.

funny like a clown

|

|

Interview with Rob Katz. He sees more buying opportunities in the northeast and seems big on Europe:

https://finance.yahoo.com/video/billionaire-investor-ron-baron-ski-114000723.html |

|

Vail Resorts, Inc. (MTN) posted better-than-expected sales results for its first quarter in fiscal year 2018 on Thursday. During the quarter, the company trimmed its net loss to $28.4 million, compared with a $62.6 million net loss in the first quarter of 2017. The company also reported an earnings per share loss of $0.71. The adjusted earnings per share loss was $2, which was slightly lower than forecasts for $1.90 per share loss. And revenue came in at $220.9 million, topping estimates for $199.33 million.

Company management noted that season passes for the ski season have been strong, so far. Sales for passes increased 14% year-over-year, while sales in dollar terms jumped 20% year-over-year. And lodging bookings at the company's North American resorts are also above last year's bookings at this time. Vail Resorts also recently declared its next dividend. The company will pay a quarterly dividend of $1.05 per share on January 10, 2016. All shareholders of record on December 27 will receive the dividend payment. The stock has a current dividend yield of 1.9%. Buy MTN below $242.

if You French Fry when you should Pizza you are going to have a bad time

|

|

I have had several of the friends I grew up with in the Midwest contact me that normally ski in Co at Epic resorts and ask about Stowe or WF for the Holidays. That got me thinking about the stock's health.

Given the lack of snow at all the Epic resorts except Whistler and Stowe I sold my stock today for a nice 42% gain including dividends. I'll monitor it and looks to rebuy again during the spring or summer watching closes for the impact that the upcoming Aspen KSL pass that includes the Intrawest resorts impact. If there is a pass price war then its probably time to stay away for awhile from this segment. Made some profit now where to invest that is the next question.

if You French Fry when you should Pizza you are going to have a bad time

|

|

I think short term weather risk is already priced into valuations, so I wouldn't be so quick to bail out on ski related investments. OTOH I am very pessimistic about the long term future of the ski business (and not just because of weather), so I have avoided VR and every other winter sports investment.

I also think that the new tax law will cause an asset bubble because companies are holding lots of cash off shore that can now come back at favorable tax rates. I'm mostly holding my equities for a little longer, even though I've reached the age where I should reduce risk. Based on my past performance, you probably shouldn't listen to my advice, or maybe do the opposite. mm

"Everywhere I turn, here I am." Susan Tedeschi

|

|

Forgot about this discussion.

The quarterly report released in June 2018 certainly painted a good picture for Vail Resorts. Somewhere I read that the numbers for the 2017-18 Epic pass was 740,000, up from 650,000 the year before without W-B. http://investors.vailresorts.com/news-releases/news-release-details/vail-resorts-reports-fiscal-2018-third-quarter-results-and-early "Season pass sales for the 2018/2019 North American ski season, excluding military pass products, increased approximately 12% in units and approximately 19% in sales dollars through May 29, 2018, compared with the prior year period ended May 30, 2017, adjusted to eliminate the impact of foreign currency by applying current period exchange rates to the prior period for Whistler Blackcomb pass sales. The Company also had significant sales of its Military Epic pass products." Came across a 2012 article that where Katz was asked "How . . . do you build a stable business around something as unpredictable as snowfall?" His was was "Make your business about much more than snowfall." There are pie charts showing the breakdown between lift ticket/pass sales and other stuff such as lessons, food, lodging, etc. Also has the breakdown for W-B, which was independent then. https://www.theatlantic.com/business/archive/2012/02/no-business-like-snow-business-the-economics-of-big-ski-resorts/252180/ |

|

This post was updated on .

Vail / Epic is getting hammered in the markets this week. I sold it a couple months ago at the beginning of the craziness going in in the markets. The season pass units went up well more than sales $ means that they are dropping the price a lot probably to compete with Ikon. Some friends that are veterns got in on those super low price military passes. They at some point are going to have to aggressively raise pricing you would think.

Vail Resorts (MTN) took a tumble today following its disappointing fiscal first-quarter earnings results. Earnings came in at a loss of $2.66 per share, compared to a loss of $0.71 per share a year ago. It was also below the estimated loss of $2.47 per share, representing a 43.6% earnings miss. The loss was due in part to acquisition-related expenses of $4.9 million and a $3.6 million loss from off-season operations. Revenues fell 0.4% to $220.0 million, down from $220.2 million last year. This was well below the analyst consensus for revenue of $235.1 million. However, North American season pass sales increased 21% in units, and 13% in sales year-over-year. Looking forward, company management continues to forecast EBITDA of $715 million to $753 million for fiscal 2019.

if You French Fry when you should Pizza you are going to have a bad time

|

|

Administrator

|

Any worse than the markets in general? Answer to my own question... um yea...

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

This post was updated on .

Whoa. BMW sales people down on the front range are having agina.

Haha. I texted that graph to my bud, and he said it looks like jumping into Corbetts.

funny like a clown

|

Nice. The Smirnoff salesguys are gonna be fine though

"You want your skis? Go get 'em!" -W. Miller

|

«

Return to Woodstove Archive

|

1 view|%1 views