Market Philosophy: What You Got?

1 ...

567891011

... 34

1 ...

567891011

... 34

|

Administrator

|

I think I do understand.

If what you're saying is true my strategy was not too bad. Super high risk, meaning an all stock portfolio, for like 30 years and then sometime in the middle of the last expansion dial it back. I probably dialed it back a bit soon. But one day I started to feel like my time to recover from a big meltdown was running low. Many would consider 65/35 risky for someone turning 60 next week. And I also started saving too late. But I don't at all regret spending my twenties as a starving artist. I guess we'll see.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

In reply to this post by Z

It's a combination of luck and courage. I think the market is pretty scary right now, and into the extended future (5 years +/-) for one main reason. With our current debt problem, and no real foreseeable efforts to pay anything off, the removal of the dollar as the world's reserve currency is a real possibility. The shock associated with that event could lead to a depression like environment for an extended period (5 to 10 years). I'm not talking about Armageddon, but I would think we would experience some unprecedented turmoil in the financial markets. I don't have the courage to have too much in today's market. Hard assets and off-grid self sufficiency are my hedge strategy.   You've obviously got balls buying GE @10. I'm not sure how to look at it. There's too much to understand... literally. It's at least a 3 year story... maybe 5. The only thing I would worry about is the potential for a reverse split. Without the health care revenue, and the current number of shares outstanding, they could eventually have a tough time generating sustained EPS growth. It's pretty diluted. |

|

In reply to this post by Harvey

He'd be living in that million acre 30,000 sqft Jackson Hole ranch and not a subdivision in the Adirondaks worrying about who his neighbors are renting to if he were a genius at stock picks.

Don't ski the trees, ski the spaces between the trees.

|

Re: Market Philosophy: What You Got?

|

Administrator

|

Can't seem to get past the paywall Johnny. Definitely interested in that story.

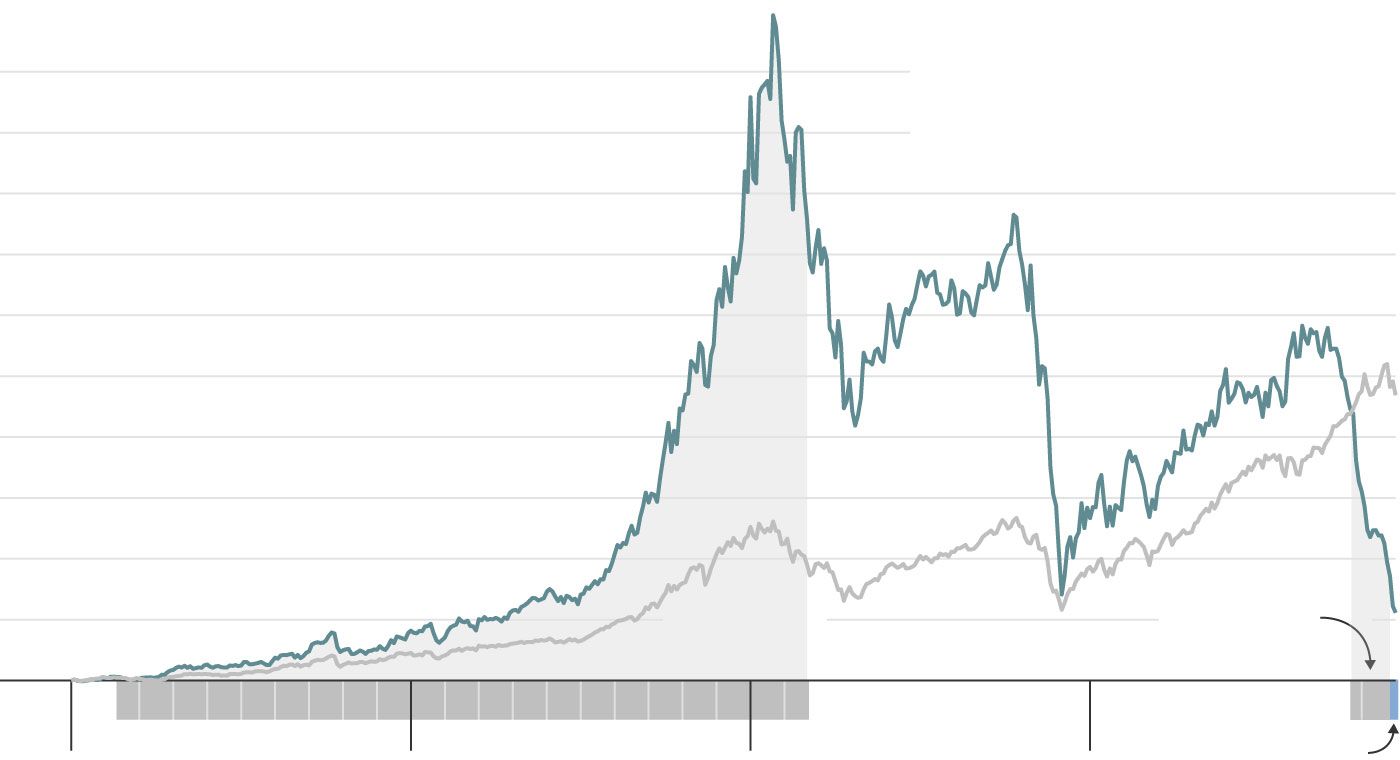

This is interesting although I have to admit I don't fully understand the buyback thing: https://slate.com/business/2018/12/apple-stock-buyback-investment-chart.html I guess individual investors aren't the only ones tempted to buy high and sell low.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

Administrator

|

In reply to this post by nepa

Not sure there is anything I can do to protect myself against that. What would be the mechanism for removing the dollar? Who would instigate, and what would replace it?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

In reply to this post by Harvey

From the link, it takes you to a few opinions on a GE article. The image doesn't save accurately for me. The fall of an American icon As General Electric looks to spin off GE Healthcare, and the style of its first outsider CEO emerges, what was once the most-valued U.S. company is trying for a turnaround. But a foray into finance, a reliance on short-term debt to boost earnings, and a slew of bad bets sent the conglomerate’s share price plummeting and bit deeply into revenue and profits, putting the fate of the 126-year old company in question. • The Wall Street Journal details the decisions that led to GE's downfall and being cast out of the Dow Jones Industrial Average after more than a century. Thomas Gryta 1w Covering GE means there is always plenty of news, but people are still constantly asking: What happened? My colleague Ted Mann and I sought to answer the question. To do so we spent six months talking to dozens of sources from all corners of the company. We traveled, visited homes, and spent many weekends and late nights juggling this project. Initially we weren’t even sure what we would do with all the information, but eventually a narrative began to emerge. This is how GE burned out: https://on.wsj.com/2Ev4f2w The Journal also heard from GE workers who reflected on their time there and how the company changed. https://www.wsj.com/articles/ge-powered-the-american-centurythen-it-burned-out-11544796010

I don't rip, I bomb.

|

|

In reply to this post by Harvey

It's a global effort that is already in progress... spearheaded by China and Russia. I would think the Chinese Yuan would be next in line. China has been hoarding gold, and is currently in the process of unloading it's vast portfolio of US IOUs. It won't be the end of the world, but it will be a tumultuous event. |

|

I took more risk with GE than I normally do but it was a realitively small investment. I know and like the new CEO but my thinking was the value broken up was more than I bought it for so the downside risk want that great. Dumb move on my part as the Street didn’t agree. It’s going to be a 3-5 yr turn and in this market I bailed after losing a couple grand. My normal method is to look for strong current earnings and sales with good guidance going forward. Ge has none of that in its foreseeable future.

if You French Fry when you should Pizza you are going to have a bad time

|

|

Administrator

|

If you believe that, why wouldn't you hold the stock for 3-5 years instead of locking in a loss after a few days?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

My wife has been in the financial industry for last 35yrs..Currency trader for almost 30yrs

She said owning and trading individual stocks is too risky.. Here colleague on her desk refuses to put his money in the market..obviously that's not smart either..

"Peace and Love"

|

|

In reply to this post by Harvey

I realized a made a mistake and moved on. No way want to hold a tanking stock up that long. I was hoping for a quicker recovery but the markets drop makes that very unlikely now. I seldom hold a stock beyond a 20% loss. If the rating drops from a B buy to a C hold I usually sell.

if You French Fry when you should Pizza you are going to have a bad time

|

|

Administrator

|

See that's a system that I don't get.

If the entire market drops by 20% and every stock in your portfolio also drops by 20% you sell everything? I made half of whatever I have in the months after 9/11 and the years after 2008. Thirty years of investing and it all came down to buying over about 4 years. Ten years ago the DJIA was at 7000. Who else was buying then? I was but it wasn't a "smart" decision, it's just what I do. I'm always buying.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

Fortunately i was up considerably in almost all my positions before the correction started so I was not facing that issue. I’ve made mistakes buying a few energy companies, GE and a couple techs this fall that the market went against. Should I sit on them for years or dump em and move on to something the market favors. Better to lose fast and get out of that position to win another day. Harv it doesn’t seem like you have the stomach for indiv stocks. You can’t fall in love with them. You can’t be afraid to admit a mistake take a loss forget about them and buy something else.

if You French Fry when you should Pizza you are going to have a bad time

|

Re: Market Philosophy: What You Got?

|

Z, just say what you really mean:

|

|

In reply to this post by Harvey

Your doing the right things. You should always be buying until you need to withdraw. Don't try to out think the market. Get an investment company working for you. The odds are against the individual investor, there is an army of investment firms trying to take every opportunity to beat you out of your money and they know how to make money when the market goes up or down.

Don't ski the trees, ski the spaces between the trees.

|

|

In reply to this post by MC2 5678F589

It certainly is legalized gambling. No doubt about it. I guess the Anolgy is the Packers were great like GE in the past but they now have a lot of over priced assets, they fired thier CEO and they have divisions not playing to thier potential probably due to attitude problems or being past thier prime(talking to you Aaron Rogers). Should I keep betting he Packets until they win Again years from now if ever or move onto the Da Bears?

Can ya tell I’m a Bears fan?

if You French Fry when you should Pizza you are going to have a bad time

|

Re: Market Philosophy: What You Got?

You should bet on the Saints or the Rams in the NFC. Bears have issues with their offense. |

Re: Market Philosophy: What You Got?

|

Da Bears !!! K Mack !!! With that D the Qb simply has to NOT make mistakes and get a lead . That D is resilient .

Life ain't a dress rehearsal: Spread enthusiasm , avoid negative nuts.

|

|

Big game today Warp. If bears win and 49ers who have been playing great lately beat rams then da bears get the 2 seed.

Goff wants no part of a game played in January in Chi town. Bears D vs Saints O would be a hell of a game. Then bears would be onto Super Bowl vs either KC or Chargers. Mack will go down as best trade in History of NFL. What a difference maker.

if You French Fry when you should Pizza you are going to have a bad time

|

«

Return to Off Topic

|

1 view|%1 views