Market Philosophy: What You Got?

12345678

... 34

12345678

... 34

Re: Market Philosophy: What You Got?

|

I dont. Maybe TJF does.

I ride with Crazy Horse!

|

|

Well Nepa is correct I was premature in buying Ge

I still think it’s worth in the teens even if you break it up and will play the long game with it. May double down at some point around 5 or 6 if it goes that low. It bounced back towards end of today’s trading I looked more at Plug. I’d say it is a quarter too early for me with that burn rate but they could soon turn the corner. I hate those private placements as they dilute earnings and get sweet terms other investors don’t get so that is my red flag on this.

if You French Fry when you should Pizza you are going to have a bad time

|

PLUG has been mired in no-man's land for 25 years. Their big move is always right around the corner. A guy I went to grad school with worked there for 10 year or so and then gave it up when he realized it was going nowhere. Avoid. |

|

Administrator

|

In reply to this post by Z

It looks like it's down a dollar or less in 5 days. How long are you planning on holding it? Seems a little early to call it a bust, unless you are day trading. The whole market was down a similar amount right?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

In reply to this post by billyymc

Agreed. Hydrogen fuel cells are a loser in more was than one. The whole process is horribly inefficient - worse than Diesel engines. It only makes sense where you have an indoor application that needs continuous duty like an indoor fork lift truck where a conventional engine won’t work and a batteries take too long to recharge.

Don't ski the trees, ski the spaces between the trees.

|

Re: Market Philosophy: What You Got?

|

In reply to this post by ScottyJack

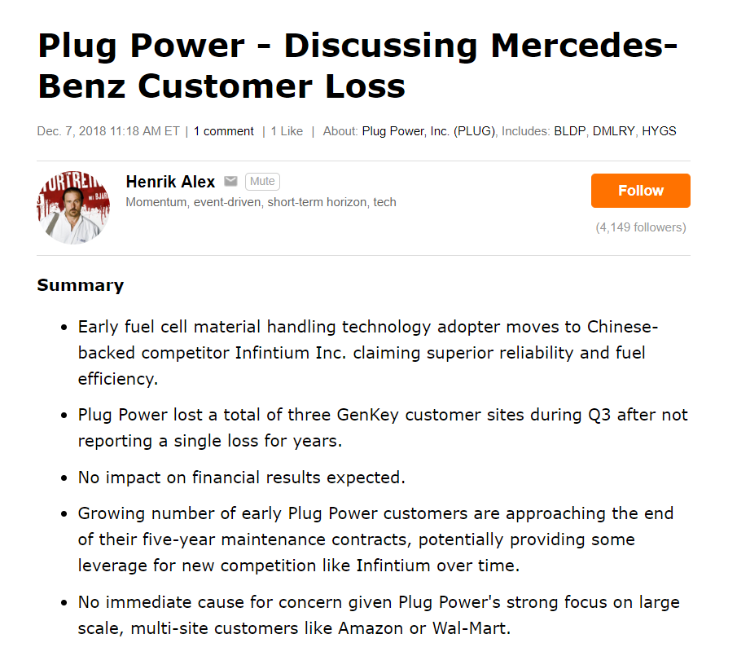

This looks like a red flag.  A major client opted to go with a much smaller, less established competitor after the expiration of a medium-term contract. From their latest financials it appears that this could be a growing problem. As is required, the author of this piece has disclosed his ownership in PLUG, so the statement of "no immediate cause for concern" is taken with a grain of salt. Also, the author's avatar diminishes his credibility with me. He kind of looks like a tool. Although it has no current material effect on their financial results, it does indicate that they are struggling to against a competitive headwind. Perhaps the Trump tariff machine could provide a near term solution to this issue. |

Re: Market Philosophy: What You Got?

|

What is it with people in this area and Plug Power? A bunch of people I know buy in and follow the news on this lame company.

Why wouldn't people buy stock in a better company? Is it some sort of local pride? Maybe it is, because people also seem to be stubbornly holding on to their GE positions as that company goes to shit. |

Yep. PP is still finding suckers, GE has lost the Welch formula. It's sad and I feel sorry for those who in the end may lose their retirement.

Don't ski the trees, ski the spaces between the trees.

|

|

This post was updated on .

In my opinion, the only think Welch did was effectively fabricate inorganic growth. GE was never meant to be a finance company. Like most modern leaders in corporate america, he robbed the organization of it's long-term viability in exchange for a few years of stardom on CNBC. It was pretty obvious that he had the hots for Maria Bartoromo. One could argue that without the carnage that resulted from GE Capital (Welch's brilliant idea), GE would still be a global powerhouse. I don't think the pensions are at risk of complete loss. If the company were to declare bankruptcy, the existing pension assets would be transferred through the PBGC to an asset manager. Benefits would be reduced, but the asset manager is obligated to manage the fund so that the highest possible benefit can be paid. Not too different than what we'll see with municipalities that have failed to prudently manage their pension obligations. |

How old are you? Do you know anything of GE when Reggie was running it? If Welch had not done the things he did they would have gone the way of Kodack, Polariod, Xerox, AMC, etc.

Don't ski the trees, ski the spaces between the trees.

|

|

This post was updated on .

I am the tender age of 45. Nope. Don't know anything about Reggie? Help me understand how? With the exception of AMC (still making Jeeps under a different parent), all of the companies you mention above make products that are now, or will soon be obsolete. The overly diverse product mix at GE is only a small part of the issue. As far as I know obsolescence in the product mix does not appear to be a big issue. I'm not saying that Welch's leadership did not stimulate growth. That is an undeniable fact. What I am saying is that his methodology for stimulating that growth has proven to be toxic for the long term viability of the company. One could argue that his methods were a necessary evil... sure, but that seems like a bit of a cop out to me. Considering the current market-cap, in addition to the extreme market cap deflation that resulted from the last crisis, Welch and his successor lead the company down a hole... they made GE extremely vulnerable to market volatility, and systemic financial risk. This is something that wouldn't have happened if the company remained a pure industrial conglomerate. I think Jack was greedy. His focus was short-term. The man took 400 million dollars in severance. In less than a decade after accepting his retirement bonus, the company was accepting a massive bailout from the Obama administration. If you include the severance of Immelt, the two esteemed leaders took more than a half a Billion in severance. The company is now in worse shape than it was after the 2009 implosion.... and we have even imploded yet. |

You just answered your own question And that's because Jack dropped things that were not making money and added things that were. Jeffey screwed the company up - he let management layer back up, he stopped focusing on performance. He hired poor managers and didn't track metrics.

Don't ski the trees, ski the spaces between the trees.

|

|

In reply to this post by PeeTex

I"m not sure why you'd lump Xerox in with companies that are basically gone, or gone. Xerox has $10B annual revenue, $6B market cap. It hasn't lived up to it's potential in many areas but it doesn't get lumped with those others. GE's business model of mega conglomerate became unviable. GE Capital dragged the whole company down during the financial crisis. Immelt was an idiot who tried to power growth by flipping entire companies - buying high and selling low. |

I lumped Xerox in there because it is no longer Xerox, it's Fuji Film - the Japanese own the controlling share of the company. I agree with your assessment of GE though but I don't blame that entirely on Jack - he got them into capital but Immelt drank too much of the coolaide. Jack initially used capital to help the industrial businesses, he would add it to a bid on a major project - finance it at a good rate with the caveat that all the equipment going into the project was GE; motors, pumps, switch gear, transformers, breakers, lighting, etc. Later Capital was also used to create equipment leasing businesses, Airlines lease engines, Railroads lease Locos. These were all smart moves to help sell equipment.

Don't ski the trees, ski the spaces between the trees.

|

Re: Market Philosophy: What You Got?

|

In reply to this post by MC2 5678F589

Full buy mode. Just emptied out the money market and got back in to 100% stocks. Also buying with some Christmas Money. This is the time I was waiting for. |

|

Administrator

|

Hope you are right.

Did you do it before yesterday:s close or after?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

Put the order in yesterday. Looks like it bought at the end of the trading session.

But I think I'll be in for a while, now. Time to ride it out for a bit. Merry Christmas, Harv. |

|

I hope you are right at at your age it’s totally the right move

I hired an advisor a few months ago soon after my employer got mergered so I luckily pulled a bunch of money out of the market to fund that profolio. They say you can’t time the market and basically I just got lucky on the timing. Buying mid term Corp bonds and planning to hold to term.

if You French Fry when you should Pizza you are going to have a bad time

|

I did that about 20 years ago. I went to a privately managed account for about 40% of my assets and have never looked back. That account has always outperformed my other accounts. I did not go all in because I believe in diversification of investment schemes.

Don't ski the trees, ski the spaces between the trees.

|

«

Return to Off Topic

|

1 view|%1 views