Market Philosophy: What You Got?

1 ...

3456789

... 34

1 ...

3456789

... 34

|

Administrator

|

Thanks MC you too.

I'm old skool. Sticking with the allocation — was 65/35, probably closer to 60/40 now with the current bear — even though "I'M SURE" markets are going down further. I guess I'm dancing with the girl that brang me. One thing is that several funds pay dividends right in the second half of Dec, so if this is a bottom, some o you dudes may have just bought low.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

In reply to this post by Z

Is your adviser playing the role of fiduciary, or salesman? Be careful, the vast majority of the players in the financial advice arena are merely salesman. This means their commission often takes priority over the long-term health of your portfolio. |

|

Get back in the game my man. Fiduciaries have been the standard for the better part of a decade. Is it better for the consumer. I can tell you it costs more, so is it better...Time will tell.

|

|

Administrator

|

This post was updated on .

About 20-30 years ago I was indoctrinated by some prolific posters on a Vanguard forum hosted by Morningstar. There were a few guys who made it their mission to emphasize the importance of keeping costs as low as possible, and avoiding the urge to buy high and sell low.

I added one thing of my own, living below our means so I could continue to buy stocks in recessions. Oddly there was one piece of advice that I ignored, and that was regular rebalancing. I never did it regularly or at all until a couple years ago, and I did it only once. Until that time I was 95% in stocks my whole life. Right or wrong I have stuck with it. Maybe I'd be a rich man if I'd hired someone to advise me to make moves. I just find it hard to trust someone who makes money when I trade, which is almost never.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

In reply to this post by nepa

My managers fees are based on the value in the account so it means the more I make the more he makes. He could just sit on his ass and just take a commission but he would have my money for long.

Don't ski the trees, ski the spaces between the trees.

|

|

Administrator

|

That sounds interesting and potentially based on your best interest. If the market tanks like in 2008 he makes nothing? I assume there is no scenario where he pays you.

Or is it based on "vs the index" like compared to the market? If I felt I could consistently add value by beating the market, I wouldn't work for others I'd do it for myself.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

This post was updated on .

In reply to this post by tjf1967

I didn't realize there was a shift to more fiduciaries than salesmen in the advisory space. I think it's a good thing. I guess it coincides with the last time I dealt with a CFP (about 12 years ago). He was raping (financially speaking of course) my soon to be wife. I looked at her portfolio and I nearly shit myself. It was quite obvious that he was acting in his own best interest (as opposed to his client's)... she had the crown jewel of poorly structured investment portfolios... a whole life insurance policy masquerading as a retirement plan. She was single, no kids, and no mortgage... Life Insurance did not seem like the best advice to me. My wife can perform brain surgery, but when it comes to money.... she's like Rain Man. |

|

In reply to this post by PeeTex

What happens when you lose money based on his advice... Does he payback previous commissions?

|

|

In reply to this post by nepa

Rain man could count cards

"You want your skis? Go get 'em!" -W. Miller

|

|

In reply to this post by Harvey

Are you re-balancing manually, or through the use of your 401k providers software? This can be a double-edged sword. I've worked with teams that develop these models. It takes away some of the investment management minutia, but can have some consequences. The models are not regulated, and of course are completely proprietary, so it's hard to determine what goes on under the hood. We would get lots of complaints from people who had their profile setup for "Auto Rebalancing," questioning the logic behind many of the automated moves. Our answer was always "It's Proprietary" but rest assured we're looking out for your best interests. The fact is, individual accounts don't mean very much to an institutional investment management company. Your benefits administrator wields all of the power. Individual account problems are merely noise... Plan level problems tend to get resolved if the correct threats are made at the right time (terminating a plan early can be very expensive)... Individual account balances that are less than 7 figures are often ignored... unless of course, and over-payment was made on a distribution. Then the institution will stop at nothing to recover the funds. Early in my tech career, I helped design a service for recovering over-payments. We could actually take money out of your bank account (if you utilized EFT) without any authorization. Heck, we wouldn't send any correspondence about the overpayment until it was successfully recovered. Pretty sneaky in my opinion. It was totally legal as a result of the fine print in the contract signed by the by the client. |

|

In reply to this post by Brownski

It wouldn't surprise me if I took her to Vegas, and she beat the crap out of the House.... and she doesn't even know how to play Black Jack. |

|

In reply to this post by Harvey

You read my mind!

|

|

In reply to this post by nepa

I feel yer pain. My wife has a nearly photographic memory. I’ve tried to convince her to read a book on blackjack a thousand times and she won’t do it

"You want your skis? Go get 'em!" -W. Miller

|

|

Administrator

|

In reply to this post by nepa

No. I started saving (401k) when I was 30. I contributed 90% stocks 10% bonds for 28 years. Always. In every market up or down. I didn't really change funds or anything. Because stocks outperform bonds over the long haul my mix was like 95/5 or even more up until September of 2016. In September of 2016 I made a big move (for me) over the course of a few days to a 65/35 mix. Since that time I've been contributing new at 50/50. With the recent drop I'm around 60/40 or so. I'll go along just like that for 5 years (age 65) and then go 50/50 unless the marketing is really in the dumper at that time. If it is I will hold out as long as I can without rebalancing or withdrawing. In some way a meltdown now might help me, so we can get going on the rebound. Unfortunately (IMO) we don't have Vanguard in our plan, it's all American Funds. American is actively managed but still lower cost than some others. The bond fund is kind of a dog, but the stock funds are decent. Wife and I also have IRA/Roths, they are all Vanguard. The rest of your post, the part I cut out, is mind blowing.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

I don't rip, I bomb.

|

|

Administrator

|

This post was updated on .

Point is...

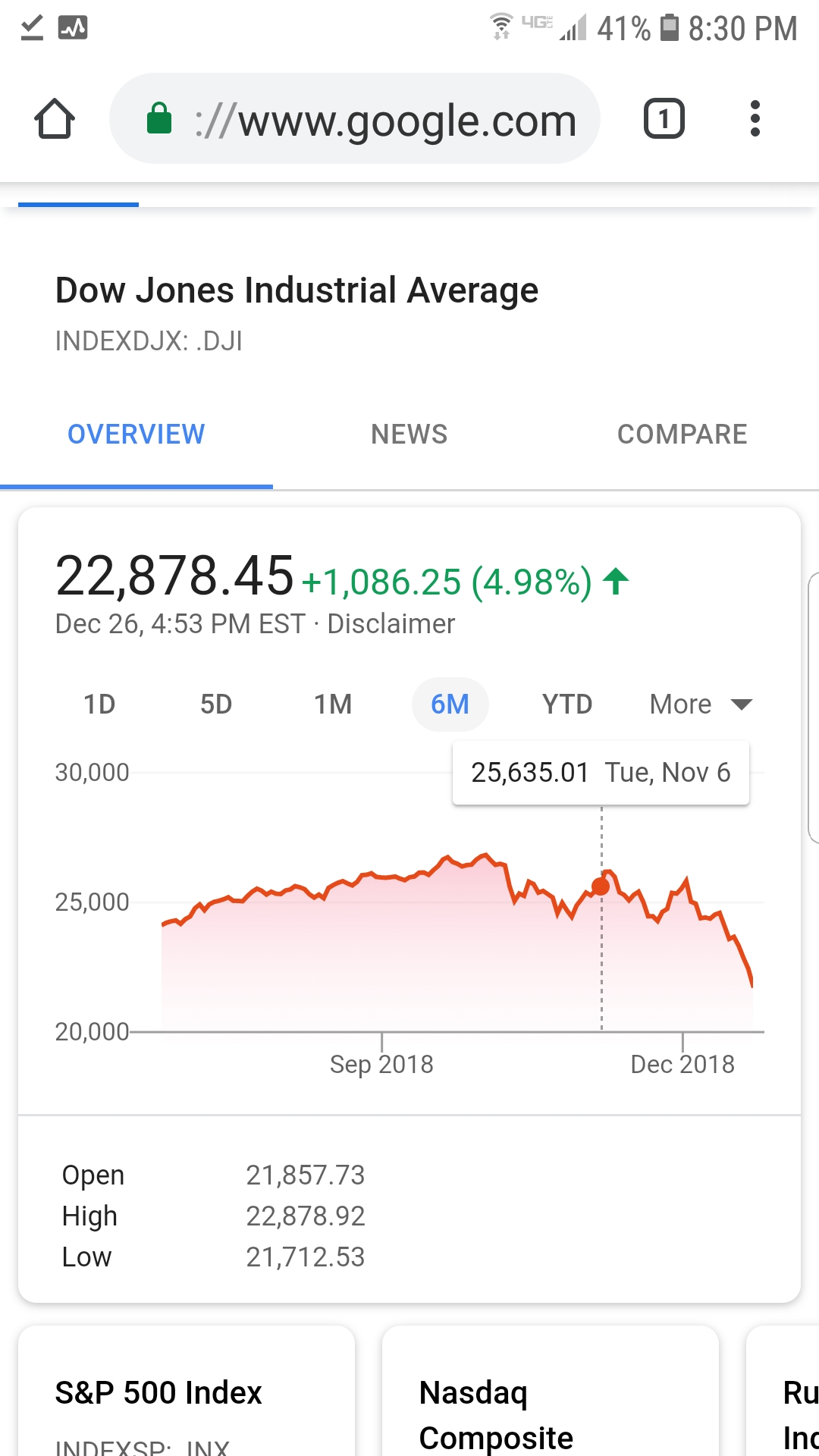

Market is down over the last six months? Most of the drop in the last six months happened since Nov 6? Today's 1000 pt rise takes us out of correction territory? This one...  is probably more illuminating. IMO.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

This post was updated on .

The market changed since Nov. 6th.

I don't rip, I bomb.

|

|

In reply to this post by tjf1967

What he said The guy I went with has been doing this for my Dad with success for years. I met with him to help with my parents planning as quickly understood this guy knew his shit and decided to go with him.

if You French Fry when you should Pizza you are going to have a bad time

|

|

Administrator

|

In reply to this post by Johnnyonthespot

Copy your post into politicrap and take it up there. Or start a new thread.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

In reply to this post by nepa

No - you and harv misread what I wrote, he gets a small percentage of whats in the account, not what the account earns. His incentive is to grow the account but he makes money regardless. It works as this account has beaten every one of my other equity type investments and consistently outperforms the market. It may not be the cheapest fee based equity account but the end result is it grows faster.

Don't ski the trees, ski the spaces between the trees.

|

«

Return to Off Topic

|

1 view|%1 views