Market Philosophy: What You Got?

1 ...

6789101112

... 34

1 ...

6789101112

... 34

|

Administrator

|

This post was updated on .

Who wasn't up considerably before the correction? You're saying that in the last 3 months you made 5 bets that didn't work out and you sold them? When you say the market went against them, does that mean they fell like the entire market or that they performed worse than the market? You're right, I don't have the stomach for your approach.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

Banned User

|

I have this general sentiment about this thread. |

|

Administrator

|

This post was updated on .

In reply to this post by PeeTex

What is the difference between investment company and an investment firm?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

Banned User

|

A firm is generally meant to mean a partnership or llc. A company is a general term for a business.

|

Re: Market Philosophy: What You Got?

|

Banned User

|

I think the lesson I learned reading the last few pages is this: if you don't know what you are doing, don't mess with the market and let someone manage it for you.

I had a few mutual fund I used to milk a few years back. I'd either just take the capital gains at the end of the year or have them reinvest and sell it off when the market was up. Honestly, it worked out about the same in terms of what I'd make. If you want to gamble, you might make a few bucks here or there. But if you leave it and take the capital gains, you might make a few bucks as well (and of course someone is managing a mutual fund for you). Unlikely you'll get rich or make enough to retire on with that strategy though and most likely won't be able to handle the losses. |

|

In reply to this post by Harvey

Company/firm in this context are interchangeable, but maybe I did not make myself clear. Investment firms/companies are out to make money and they do it by taking other peoples money in two ways, one by charging fees and two by beating other investors in the market. The people they take fees from (if you have a good firm) they work for and they try to make money for them as well as make money from them. It's like hiring a roofer, you have no problem paying a guy extra who will put on a good roof that won't leak, why should you object to paying a guy who can watch your money and help you make more. You would pay extra for a really good roof rather than cutting corners and finding the cheapest roofer and getting a roof that leaks after a few years. You won't feel bad at all for paying extra for that roof. Why should you feel bad for paying more to the guy who makes you more money. If you decide to put that roof on yourself, well you may get it on your house but it may rain in the process and ruin your sheet rock costing you more, you may fall off the roof and hurt your back, you may get the roof on but because you spent time doing that you lost a client who needed you to complete a job, you may know nothing about roofs and so you end up worse than if you paid even the cheapest guy who would have put on a shitty roof. Now did I make myself clear?

Don't ski the trees, ski the spaces between the trees.

|

|

Administrator

|

It sounded like you said investment company/firms are out to get me, but I should hire a good one. How do I know if they are good? In my experience with our company plan, I had to threaten to pull the business to get full disclosure of the fees.

With a roof, I compare prices, and hire a guy who offers a contractual guarantee. If it lasts 30 years and doesn't leak, I know that I got something. If the roof leaks sooner, he fixes it or gives me something back. With investment advice what is the recourse? I'll never forget meeting the guy who sold my old girlfriend and her coworkers (nurses) a big pile of annuity crap. These were sincere women who spent their whole lives caring for people because it came naturally to them. I showed up at this meeting and hammered him hard about the cost. After quite a while we learned he was charging a load plus 2%. To me that's criminal fraud. In any case, this is moot for me. Most of what Zelda and I have is in my 401k. I can't see hiring an advisor to help me with that. What would he do, help me pick funds? The options available to us are through American Funds, they have a few good large cap growth funds and that is it. Even the value fund is on the growth side. I don't need an additional fee to choose one.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

You should be able to easily get a full disclosure of the fees - if they are reluctant to give you that then they are probably not a good firm.

Sounds good in principle, but what if the roofer quits the business and your "guarantee" is not worth the paper it's written on? In that case it's just like investment advice. Annuity's have their place - a corporate retirement is like an annuity. It can be a safety net but it probably should not be your entire retirement income plan. But again you missed the point. What I have been trying to say is, lets say you have firm A that charges you 1% and firm B that charges you 2%. You decide to go with firm A because they have lower fees. Over a 5 year period your net is 5%/year but your friend went with firm B, he paid a higher fee but they earned him 8%/year over the same period. Who did better? You may not, that's for you to decide. I'm not saying you should do what I do.

Don't ski the trees, ski the spaces between the trees.

|

Re: Market Philosophy: What You Got?

|

In reply to this post by Z

Z: DA Bears win. 12 and 4 baby !!!

Life ain't a dress rehearsal: Spread enthusiasm , avoid negative nuts.

|

|

Better yet the Vikings are out and the Packers got their asses handed to them by the Lions. It was a good day.

if You French Fry when you should Pizza you are going to have a bad time

|

|

In reply to this post by Harvey

Not suggesting this applies to your situation but here's what happened for me when I set up an account with my financial planner 25+ years ago. The amount of money that he was handling was a small portion of the total financial assets that my husband and I held back then. He managed my account. When I started with him, I had a 401K and a small IRA. When I chose to retire early, everything was rolled into an IRA that he manages. He also provided tax planning advice, retirement planning, and answered my husband's questions about the investments that he was making on his own in his accounts. That included advice about choosing fund options in my husband's company's IRA. My planner didn't charge anything extra for the "consultation" time. He takes into account all of our assets in deciding how to invest my account. For assorted reasons, my husband recently decided there might be value in having help. Ended up setting up an account with a different financial planner. That man is a better fit in terms of having the patience to answer my husband's questions. It's also a small father-son company but they both like teaching their clients. Even have monthly lunch seminars, which are pretty useful. Our assets are split between accounts my husband manages directly and accounts with the two small companies. He has some individual stocks. We are well diversified in multiple ways. |

Re: Market Philosophy: What You Got?

Which accounts have done better? Like, my thing is not "if finanicial planner X charges 1%, and makes 5% a year, while financial planner Y charges 2%, and makes 8% a year...". How about I just pay 0% to financial planner, pick a bunch of low-cost, diversified mutual funds in various asset classes, and rely on broader market trends to provide a decent return on my investments? In addition to that, I can gamble on single stocks or football or whatever I want with my other money. Stock trades are like $4 now. It's a new world. This doesn't seem like a complicated concept. Going without a financial advisor means I can keep all of my returns. Also, I don't have to spend time finding an advisor I can trust, making sure he actually adds value, and keeping an eye on him to make sure that he is doing the right things with my money. Also also, because I don't have an advisor, I know exactly what my money is invested in and exactly what my returns are. So much of today's society is old curmudgeons sticking to their old traditions (financial advisors, annuities, buying individual stocks in dying big named companies because of questionable assumptions, secretaries that handle logistics, etc.) while young people are able to do all the things old people farm out because the young people have phones, internet connections, and the accumulated knowledge of millions of financial advisors, customers, and people who have done this stuff before. Nice anecdotes, everyone, but I'd like some real data: What value does the average financial advisor add? How much of that value is in correct stock/mutual fund picking & market timing, vs. how much is in diversification strategy, buy & hold, and convincing their scared clients not to pull their money out at stupid times? Does anyone have any numbers on this stuff? |

Re: Market Philosophy: What You Got?

|

Banned User

|

MC - I'd argue that if you buy mutual funds, you buy them WITH a financial adviser. You have someone managing that account and picking stock that will do the best within a given pool.

I've been SMH wondering why anyone would buy individual stocks these days. I guess if you want to make a big gamble, but mutual funds provide, for me, a much better risk/reward ratio. I had 1 stock ever. (sorry, this is an anecdote). It was 100 shares of Kodak given to me when I was in my late teens. Kodak was really high then. Probably because, like a dying star, they were burning brightest before they were reading to explode. I can't remember if I just wanted liquid cash or if I just had a feeling because of the oncoming digital age, but I wanted to sell that stock IMMEDIATELY. It had been in my family for years and we live in the city where Kodak originated, so there was a lot of push back from my family to keep it. I also wasn't of age yet to make my own decision with it, although technically it was "given" to me (BS blah blah blah). So basically I had to sit and watch that stock die a slow death until it was finally signed over entirely to me. I forget what is worth then, but I want to 1/10 of what it started at. I didn't even touch it. I don't even know what happened to my paperwork for it. I don't even care. I just pretend I never had it. So TL;DR version, I will never buy single stocks. I made my comment before based on the fact that some people in this thread could probably benefit from a financial adviser as they seem to be losing money. I'd also say if you have a 401k, that's just sheltered mutual funds, so there's no reason to have an adviser unless you need someone to help you decide how much to put in throughout your career. They should be able to figure that out in one appointment. As far a Peetex, he made some good points, but I'd like to know how old he is and why he hasn't retired. Perhaps his strategy isn't as good as he makes it out to be. |

Re: Market Philosophy: What You Got?

|

He's like 68 or 69 (I think) and he strikes me as one of those guys with a very high opinion of himself who thinks that he needs to keep working to show off his expertise and provide a bunch of money for his heirs.

He has mentioned something about that before:

|

Re: Market Philosophy: What You Got?

|

Banned User

|

I'm not saying Peetex is this way or that, but I knew a lot of people like that in my former career. It's a shame because they tend to stifle progress even though they may have lots of experience.

As far as what I do know about Peetex, I recall him saying he couldn't imagine living off less than 6 figures a year (sorry, don't know where that quote is), so I'm not sure if he just has a ton of debt, or if he's burning $1 bills for heating fuel. So, so, so many people live off way less than that. And many are retirees. I was always very unclear on that statement. If you get to a point in your life where you have very little expenditures, you don't need a large income to live. |

Re: Market Philosophy: What You Got?

Yep. Both nepa & PeeTex are conservative "retired" guys who have done well enough in their working lives to live out their remaining years doing whatever they want to do. But they had wildly different paths, have wildly different current lives, have wildly different opinions on how to achieve success, and have wildly different outlooks on life. Might have something to do with the 20-year+ age difference. The way nepa did it seems more relevant than the way PeeTex did it. I feel like a lot of older people suffer from this kind of mindset:

|

|

Administrator

|

In reply to this post by MC2 5678F589

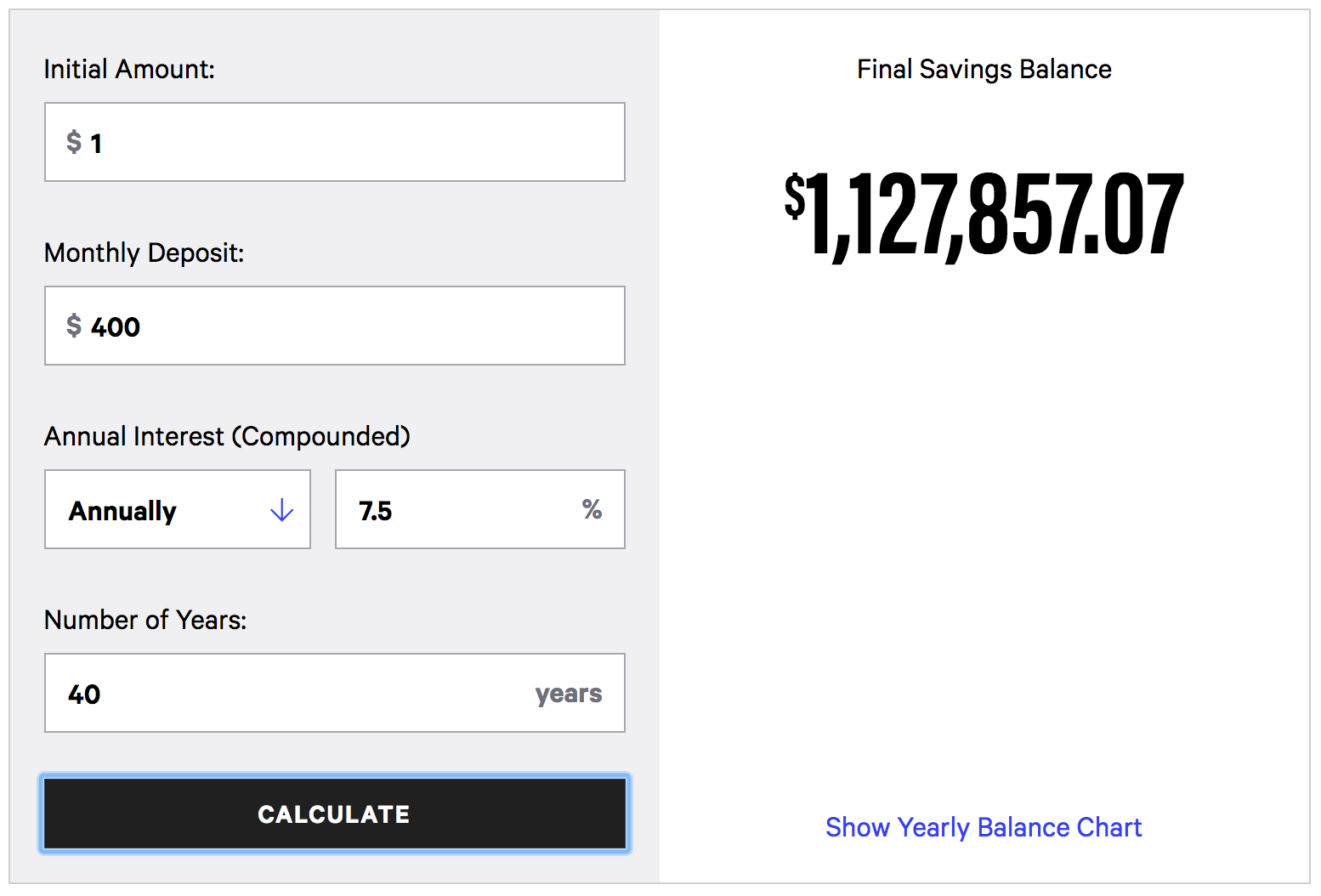

That pretty much sums it up for me. I don't know how to do the math on compound interest* but I'd bet that if you saved a modest amount every week from age 25 to 65 and it returns the longterm market average minus a low expense ratio, you'd probably have something. I'm convinced that the key to that strategy is to live below your means. When we had our daughter we reduced our savings rate from 30% of income to 15%. When 2008 melted down my pay was cut 20% and we had to cut savings further to 8%. Still we were able to buy stocks, when prices were low, because we we living below the max. The single stock thing seems to value the big score (with the attendant extra risk) over having "enough" whatever that is. FWIW I love this topic. We all got opinions, I like hearing them. *can someone tell me what you would have if you saved $50 a week for 30 years with 7.5% return every year? What about $100 a week?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

$277,112.60 $555,499.34 https://www.bankrate.com/calculators/savings/simple-savings-calculator.aspx |

Re: Market Philosophy: What You Got?

|

Banned User

|

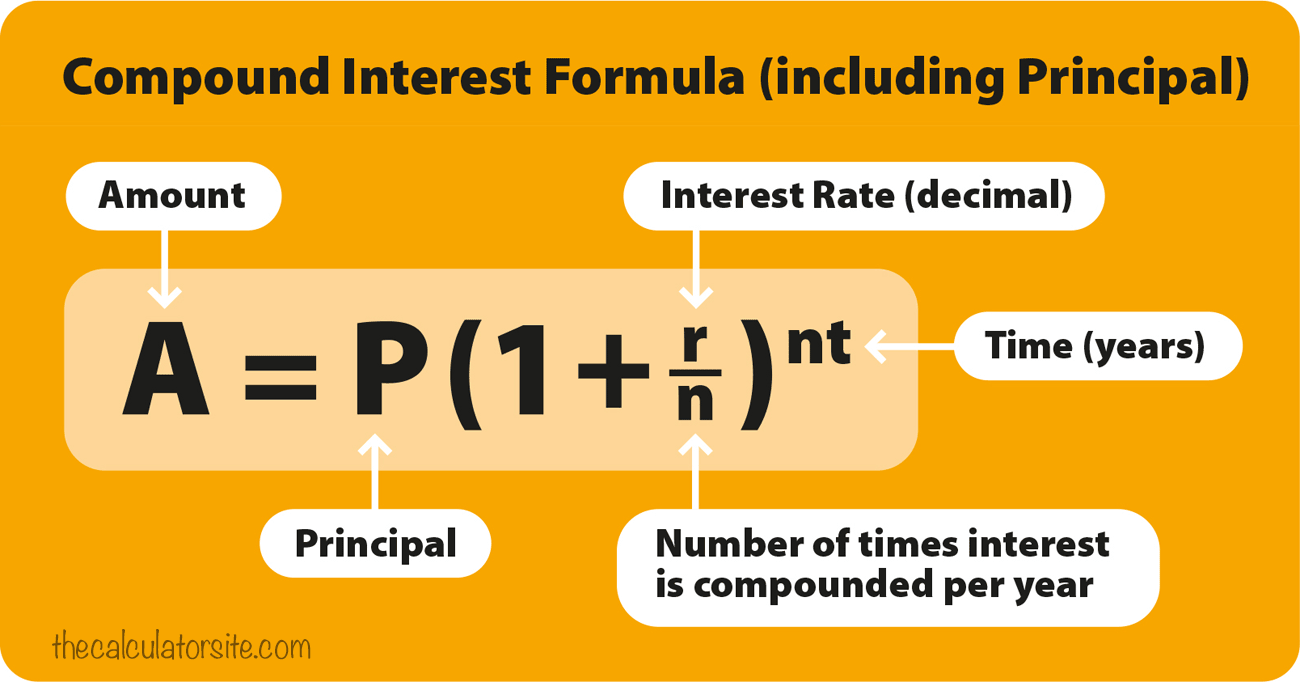

Or more generally:  This is one of the most famous formulae in mathematics and if you took calculus you'd probably remember what this becomes when you compound infinitely. It just so happens that it's also the one thing that's rate of change is equal to itself and shows itself constantly in nature*. *I enjoy this subject much more than thinking about markets. |

|

Administrator

|

In reply to this post by MC2 5678F589

I guess you can't do a weekly contribution. MC did you use annual compounding and start with $1? What settings did you use?

I f'd up on the 30 years, 25-65 is 40 years. (haha maybe I do need an advisor!) If I did this right it shows the importance of starting early:  I remember when I first started to save the Dow had a huge drop on a day I think they called Black Monday. It went from 2000 to 1500 in one day.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

«

Return to Off Topic

|

1 view|%1 views