Market Philosophy: What You Got?

1 ...

17181920212223

... 34

1 ...

17181920212223

... 34

Harv, If your 80 with $5M invested there would be no reason to go into cash. When you hit 70 you stop thinking about yourself and start thinking about your kids. You take out what you need for end of life care, get the best yield to help the next generation. That is, if you love your kids. If you are super rich you make sure your kids are well taken care of, the rest you leave to a good cause.

Don't ski the trees, ski the spaces between the trees.

|

|

Administrator

|

OK maybe a bad example.

It doesn't change the fact that comparing people with different asset allocations makes no sense. I warp up year to date, it's pretty unlikely he's 80% in stock. Once your "needs" are met, whatever they are, there is less need for risk in your portfolio. If I was 25 years old and started my 401k today, I would be all in on risk. For the record, I do love my family.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Didn’t mean to insinuate that you didn’t love your family. I guess I think opposite from you. My theory is - until your needs are met stay out of risky investments. Live below your means and build the foundation, then start taking on risk where you can afford to ride through market dips. For people who are working and could lose their jobs building that base is hard. When I first started working we lived in crappy apartments and drove shitty cars for about 5 years even though we had a good income. I then had enough foundation to start my first business - that was my risky investment at that time.

Don't ski the trees, ski the spaces between the trees.

|

|

Administrator

|

I had always kind of assumed that however much you need to retire, it was probably 50/50 chance beyond reach, for me.

IMO two kinds of risk: Too much risk Not enough risk I've said before I was 90/10 for 30 years until 2 years ago when I switched to 60/40. They say you never REALLY know your risk tolerance until it is tested. Wishing now I was 50/50, but not going to address that until market returns to it's highs. If that doesn't happen before I retire, I guess I'll cross that bridge when I come to it. Still doesn't change my opinion that comparing portfolio performance for different asset allocations is meaningless. This: ...is the perspective of a high income earner. If you KNOW you are going to get to an amount you can live on for 30 years, you can approach it this way. But if you make 50k a year and save 15%, you are going to have to take some risk.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

I think it’s about what you think you need to live on as well as what your family demands. I recall you are a follower of Mr Money Mustache, his advice is pretty good. I deviate from it slightly with an extra layer of caution.

Don't ski the trees, ski the spaces between the trees.

|

|

Administrator

|

I like MMM. I don't really follow him, but when MC told me about him I read a bunch of his stuff and agreed with it.

Basic ideas i agree with: Live below your means Keep costs low Diversify Never stop buying (before retirement I guess) Never sell stock in a downturn

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

This post was updated on .

In reply to this post by PeeTex

Oh i hear ya bro, loud n clear re end of yr tax positioning .Quarterly dives are about right for most ..

Me ,i am an old Dismal Scientist ( Econ. Major) who is a bit anal retentive 😆 So like crunching the numbers . Right now , no rash moves, biding my time ,but poised when that containment curve starts to move .

Life ain't a dress rehearsal: Spread enthusiasm , avoid negative nuts.

|

Re: Market Philosophy: What You Got?

|

I'll let you guys know when my prototype is finished.

I don't rip, I bomb.

|

Re: Market Philosophy: What You Got?

|

Johnny had a team of 1700 google engineers working round the clock on that one!

|

|

It appears the rate cut and other announced Fed actions spooked the market - futures locked limit down. The rate cut was unnecessary but forced due to political pressure. And it panicked the markets.

|

Re: Market Philosophy: What You Got?

|

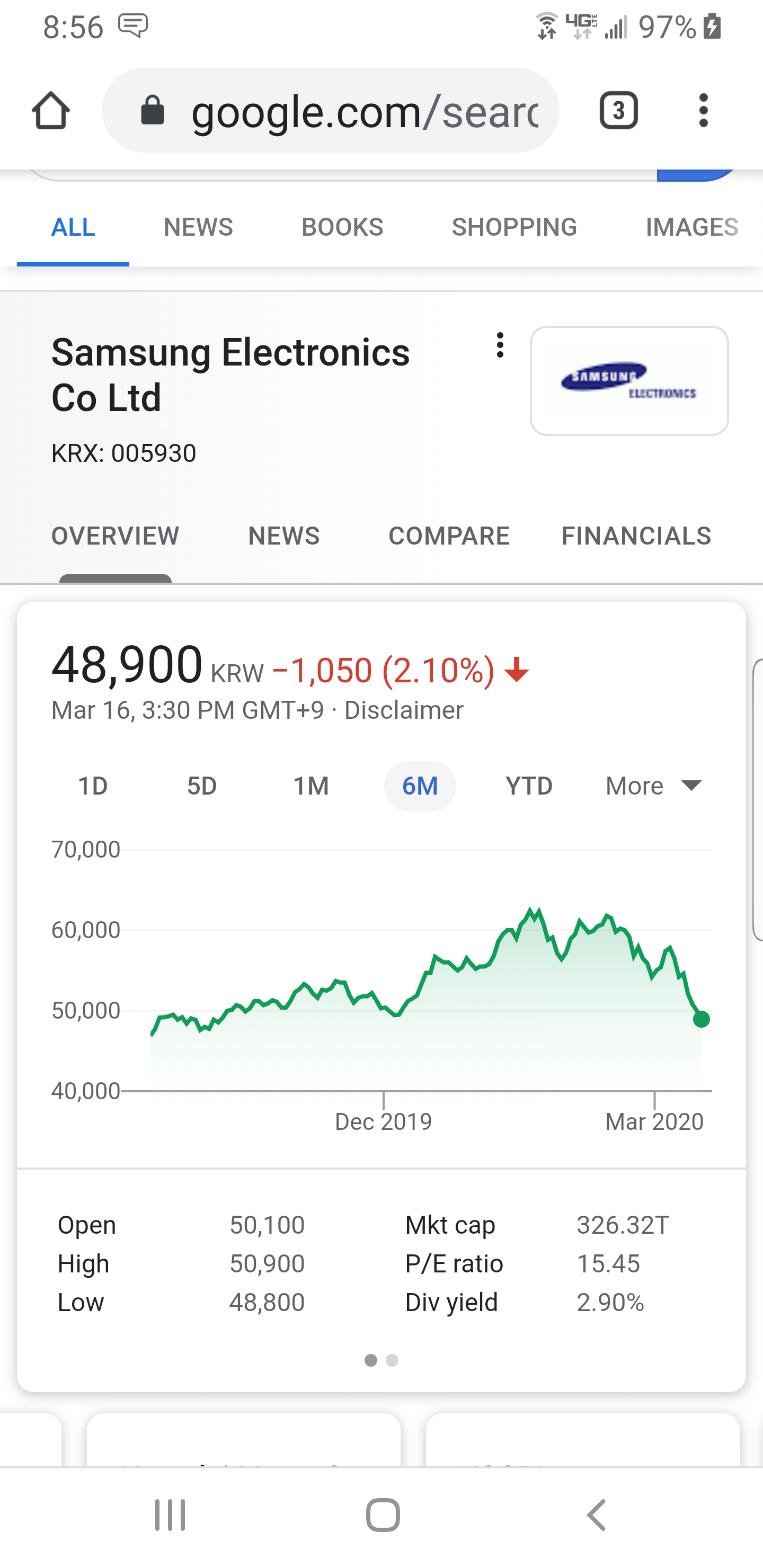

Samsung has revealed a solid state battery with a 500 mile range. Buy or wait a year?

https://www.caranddriver.com/news/a31409442/samsung-solid-state-battery-revealed/

I don't rip, I bomb.

|

|

It's no secret that the press conference last friday was timed to not allow the market to absorb and react.

If there had been, it may have been down anyway but not in the way it appears it's goign to be today. Europe is down over 10%. Hold on to your pennies people, you're goign to need them. |

|

Locked right at the open.

Everything that is being done is increasing the panic in the financial markets. The Fed move should have been slow rolled and whispered this week, announced at their regular meeting. Forcing it over the weekend, with the threat of replacing Powell, added to the panic. Stupid stupid. There was no need to rush it, except someone thought it would boost the market. It doesn'y work that way when the problem isn't tight credit or lack of liquidity. |

|

My wife is a currency trader and does funding for her bank..She said there is a huge liquidity problem , but was still surprised by the cut on sunday

"Peace and Love"

|

Yep - sorry, I agree there is a liquidity problem, but not necessarily one that can be solved by a surprise rate cut. Do'nt shock the markets this way. |

Re: Market Philosophy: What You Got?

Only solution is to deliver "liquidity" to the people that will spend it - the poor & middle class. Time for a universal basic income for the next couple of months. |

|

In reply to this post by billyymc

The man wanted lower interest rates... The virus is the excuse to get them.

|

|

Well. That was interesting.

DJIA: Biggest point drop ever. Second biggest percentage drop ever. If you take credit for Friday, you gotta take the blame for today. What happens tomorrow? Other than continued volatility that is. |

Re: Market Philosophy: What You Got?

|

Exclusive spy photos from the lab. This one's a game changer.

I don't rip, I bomb.

|

|

In reply to this post by billyymc

Monday’s drop was a surprise to me and is a perfect example of why I leave this shit to the pros. I’m not making any investment withdrawals - just going to live off reserves for a few months now or for as long as it takes to recover. Life goes on.

Don't ski the trees, ski the spaces between the trees.

|

«

Return to Off Topic

|

1 view|%1 views