Market Philosophy: What You Got?

1 ...

15161718192021

... 34

1 ...

15161718192021

... 34

|

Around 3 I almost was about to buy MSFT and HOLX but decided to hold off

I think we are seeing some more panic before the real bottom im thinking early next week is when to buy

if You French Fry when you should Pizza you are going to have a bad time

|

|

Administrator

|

Splain Ricky.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

Fed meeting is next week plus the Russians and saudis might sort their beef out

Looking for some better news on the virus front. It was declared a pandemic so now emergency regulation of therapeutic and vaccines can speed up the process. At some point the price on equities will be so low buying will happen.

if You French Fry when you should Pizza you are going to have a bad time

|

|

This post was updated on .

You're going to have to wait for sometime for this to happen. It's still only going to get worse. And, [the] President has classified all meetings on the virus, which means that government experts, including scientists cannot attend the meetings. |

|

Stock index futures hit limit down in overnight trade. There's a good chance when the stock market opens today it will trip circuit breakers and hit a mandatory halt like it did on Monday.

There's no clarity on when this ends. Even if the market rolls over, with full capitulation today, there is still tremendous uncertainty about how much the US and the global economy are going to be impacted by the coronavirus. It's an old adage that the markets hate uncertainty, but clearly still true. We'll see a turnaround when it becomes clear our government has some handle on this and is taking decisive action at the top level. Right now we have chaos in our response in the US with states and localities making up their own plans because the fed govt has failed to act. Having said that, I'll probably put a little more of my 401k back in today. With a 6 year horizon it doesn't make sense to try and catch the exact bottom. I do think we're now at 50% chance of going under 20,000 on the Dow though. |

Re: Market Philosophy: What You Got?

So we're fucked? Last of my cash went in this morning. I'm in for the long haul now. |

|

Administrator

|

What did the Fed do at 1pm? Why did it have an effect for an hour? Why was it shortlived?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

They announced plans to support the financial markets, and potentially the economy. Appear to be many of the same types of things they did during true 2008 financial crisis...essentially pumping money into the credit markets, creating programs to keep businesses going. There is a lot of odd stuff happening in the markets at the moment - things out of sync, moving in lockstep instead of inverse movement, etc...signaling buyers of ALL assets are drying up, not just stocks.

It was short lived because it doesn’t address the US lack of preparedness for this, doesn’t address why we’ve tested about 10,000 people at best when South Korea (which appears to be containing the spread there) was testing more than that a day. Doesn’t address that we will run out of hospital beds, ventilators, etc. Another reason it’s short lived is it signals how desperate the situation with the markets has become. It’s not clear this will work. And since we had an unecessary tax cut, our deficit has gotten huge and now likely to grow much faster. We could have paid it down and been in a much better position right now. Markets hate uncertainty Harv. This move doesn’t do much to provide clarity |

|

Administrator

|

Thanks, understood. Still don't the positive reaction, for only a moment.

None of the fiscal stimulus makes any sense to me. I agree with you, move on the problem vs just throw money at it.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

Harv - one more point. When the financial crisis occurred in 2008 there was a concerted global effort to deal with it. Central banks coordinated and cooperated.

As you know, we have a different situation now where our current administration isolated us from the rest of the world. |

|

That got ugly. Accelerated losses into the close.

I am 70ish percent back in. Not confident that the bottom is in but it’s a fools errand to try and catch the exact turn. Even though I got out before the crash it feels bad to watch this unfold. I guess the most positive thing to be said is we are probably near the bottom if we didn’t hit it today. |

|

Administrator

|

I don't get how you guys (not just billy) feel like you can call the bottom.

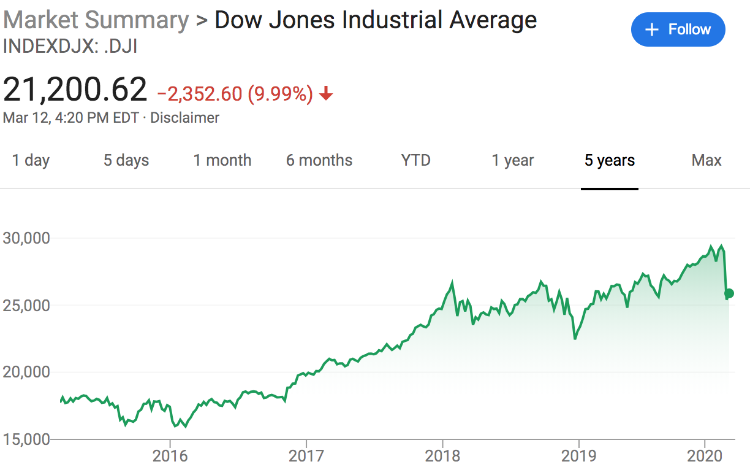

Who knows what will happen. If 50,000 more cases are reported tomorrow and 1000 people die, they market could drop another 2000 points in a day. Imagine if this line went straight from 2016 to today. No one would be thinking twice about it. So is the market overvalued, undervalued or just right? These shocks tend to bring it back in line right?  Most of what I have came from continuing in 2000 and 2008, just kept buying, never sold. Makes sense for me to stick to what I know. Big EXCEPT: I'm a lot old and closer to retirement. Maybe. Hope so. Got 3.5 years to get back to 29,000.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

In reply to this post by Z

International stocks down about 17% in the last month. U.S. stocks down about 28% |

Re: Market Philosophy: What You Got?

|

In reply to this post by Harvey

Meh. The stock market returns an average of 10.4% a year (or so). The last 5 years has seen the S&P Index gain about 27% (after today's losses). So, the last 5 years have been returning half of what can usually be expected. The last 10 years, however, has seen around a 130% increase (13% a year), coming out of the GW Bush recession. BUT, the last 20 years has only seen about an 82% gain (4% a year), which grabs some of the 2000 dot com bubble. All that to say: I don't know. I feel like stock investing is the best return, but yeah, there are always risks. I'd love to be able to perfectly time the market, but only Z can do that (and only in his mind). |

|

In reply to this post by Harvey

Ha sorry - I’m posting too much I guess. Harv if I could actually predict tops and bottoms I wouldn’t be posting here because I’d be busy shopping for a new mountain home. Based on previous market crashes I’m guesstimating about a 35% drop from the highs. If I was positive about that I wouldn’t have started getting back in already. But this feels unprecedented and maybe that’s way off. Maybe it’s a 50% drop or maybe we hit the bottom today. Maybe more importantly than the size is how long this drags out. Lots or predictions this won’t be a v shaped bottom. |

|

Administrator

|

This post was updated on .

Not calling you out, and don't stop posting because of me. This is the one of most interesting non-skiing threads to me. I feel like the goal is unachievable, but at the same time you can make significant progress. That sucks me in.

There is this old guy named Taylor Larimore, I think he is still alive. I was a member of a forum, once a million years ago, for about 5 years. Taylor was clearly wise and seemed loaded. Everyone respected him. He just kept saying, get an allocation you are comfortable with, buy ultra low cost funds, and never stop buying. Up until now, and maybe now too, it has worked for me. I'm not immune to timing. My wife just got a modest sum from her dad, maybe two months ago. She was asking me what to do with it. She's younger and I think it should be in stock, in a taxable account, something tax efficient like VTSMX. I have been telling her to hold off a while. If she jumps now she's in at 22 or whatever instead of 29. Should probably invest it tonight. But might not. That's as market timey as I get.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

MC just because Trump said it doesn’t make it wrong. The US economy Is fundamentally the strongest in the world by really far. I’m still going to strongly underweight international equities going forward.

As we were nearing a top I had taken money out of equities over the last 3 to 4 months. Unfortunately I wish I had sold all them. As I said no one can time the market. I’ve been selling for the last two weeks up through yesterday some still at lowered profits and others at losses. What I have left I feel are positioned to gain. I’ve tried to buy in a couple times with small amounts. This could get really ugly for another week but I saw some signs of good stocks not being down that much this afternoon so there are some sign of buying undervalued good companies.

if You French Fry when you should Pizza you are going to have a bad time

|

|

In reply to this post by Harvey

Harv, if you 3.5 years from retirement then start thinking about setting aside money in low risk investments, CDs or bank accounts. The yield will suck but when you retire you won’t be forced to withdraw in a down market.

I spoke to a young college student this week. He had his tuition money for law school in the market. He Panicked and pulled it out. Now he won’t have enough to go. Never put what you will need in the next year or two in risky investments. At least that’s my rule. I will likely let my cash position drop as I ride this out and then replenish it when things get back to normal.

Don't ski the trees, ski the spaces between the trees.

|

Re: Market Philosophy: What You Got?

|

How do you all buy in to your investments? Through a broker, E Trade, or are you adjusting 401k's?

I don't rip, I bomb.

|

Both. Remember that Non-retirement accounts have tax implications that retirement accounts either don't have or defer. I wouldn't try to catch a top or bottom in a non-retirement account for that reason alone. I got lucky and got out near the top in my 401k, and am getting in again. I say lucky because it's so hard to actually time the turn and so easy to miss it and get left behind. |

«

Return to Off Topic

|

1 view|%1 views