Market Philosophy: What You Got?

123456

... 34

123456

... 34

Re: Market Philosophy: What You Got?

|

This post was updated on .

Harv : everyone is different , it is folly to give specific advice without knowing individual's risk tolerance and how much they may have safed up to date and wht their horizon looks like , age , health , dependents goals etc

MC as a younger man has a longer horizon and seeks tax avoidance this year i get that , but others may need to safe up a portion or significant portion depending on their personal horizon . Ipersonally did exactly that in 2007 before the fit hit the shan , i went back in gradually over that span but safed up a pretty substantial sum because a small percentage of a big number IS STILL A BIG NUMBER . That said you have a young daughter and i know how you love your family and given your age and moderated by your personal goals for Neve and your family , you WILL do the right and prudent thing .. Hey you are a. Bright guy with goals and aspirations so keep focused and listen to your inner voice . All the best and of course Merry Christmas , Happy Holidays and a healthy and happy New Year to you and the FAm. W

Life ain't a dress rehearsal: Spread enthusiasm , avoid negative nuts.

|

Re: Market Philosophy: What You Got?

|

Gold.

I don't rip, I bomb.

|

Re: Market Philosophy: What You Got?

|

In reply to this post by Harvey

I never rebalance, but I did a bit of it for this reason (only about $25,000 worth, from stocks into "fixed assets", or whatever they call the money market account in my retirement system). I'll probably switch it back at some point next year (half in February, half in June), then switch my contribution back to 100% stocks in August or so. |

|

Administrator

|

I wasn't really asking you MC I was just throwing it out there. I never rebalanced until I was 58 (last year) so I agree with your strategy. I also was making the assumption that "people" have most of their stuff in tax deferred, which is probably a flawed assumption.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

My Wife handles all of this stuff..

1/2 in tax differed , the rest in mutual funds/cd's/bonds.. no individual stocks..her work doesn't allow it..

"Peace and Love"

|

Re: Market Philosophy: What You Got?

|

In reply to this post by MC2 5678F589

Couple thousand more down, then it's time to get back in. |

|

Administrator

|

Interesting. I am really not a market timer, and my 401k actually doesn't allow it.

I moved a bit on Monday or what ever day the dow dropped 100 points. I felt pretty guilty about doing it but maybe the difference for me is that I will never move it back into stocks. I'm on a path to get to 50/50 or maybe 40/60 by age 65 (6 years) and any moves I make to go more conservative will not be undone. (I'm at about 65/35 now from 95/5 18 months ago.) The only thing I might do is if the market really craters I might change my contrib mix which is now at 50/50.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

Administrator

|

So right now Jan 26 is the "top."

Anyone make any moves? I mentioned above that I went from 95/5 to 65/35 last year. Yea I missed out to some extent but the reduced volatility is nice.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

I pay people to do this, wascdown about 1% last month but not concerned, I have faith in my team

Don't ski the trees, ski the spaces between the trees.

|

Re: Market Philosophy: What You Got?

|

In reply to this post by Harvey

832 Down. That seems big.

And down over 1,000 in post market. Oof: https://www.cnbc.com/pre-markets/ |

|

time to buy!!

"Peace and Love"

|

|

Administrator

|

Always be buying. Well at least for 5 more years.

What happened? Jitters about... inflation? interest rates?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

In reply to this post by JasonWx

🤔🤔🤔🤔🤔 Not sure about that. But, I don't know what the fuck is going to happen really. Really, I don't know how this tax reform is going to play out. Will people try to sell a bunch of stock that has been down before the year ends (to try to balance out gains from taxes)? Will the loss of the SALT deduction above $10,000 screw rich stockowners over? What about Inflation? Did stocks run up because of the cheaper American dollar, or because of fundamentals, stock buybacks, and corporate tax cuts? If the Dow drops another 2,500 to 5,000 (10-20%) before the year is out... I'm definitely in buy mode. |

|

Administrator

|

This post was updated on .

When was the last time you bought stock?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

Every two weeks I guess I buy some. But I could always buy more.

|

|

Administrator

|

Leave some in cash, in case of a crash, break glass?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

In reply to this post by Harvey

I have had very little money on the table for the past couple of years. To be honest, I have no idea where we are going from here. I thought we would have completely imploded long ago. Consumers and corporations are awash in debt across the board. Many of people bought houses over the past year that are worth much less now than 6 months ago... what happens when those people lose their jobs? Could we see a chain reaction similar to the last Great Crisis? Over the past 10 years, many corporations have manufactured acceptable numbers via stock buybacks. The earning growth we have seen is in many cases is a complete sham. Tack on the complications of a war on trade, and we could see an significant economic crater in the near term. More people are working, but essentially, both sides (employers & employees) are making about the same amount of money. Obviously, in a business environment that is addicted to Growth, this can't go on forever... at some point, Trump will fart, and that fart-driven breeze will blow the house of cards right off the table. That said, occasionally, I do enjoy going to the Casino. My current approach to the market is to treat strategy more like a game of chance, as opposed to a long term investment endeavor. I focus on 1 stock with a very short time-frame. Recently, I have been trading TNDM. I met one of their engineers on a dive trip in January. They make an insulin pump system. According to one of my diabetic friends, it's the best thing on the market. I obsessively watched the stock for about six weeks. Read a few reports... watched a few Youtube vids. I wouldn't exactly call it research.  I started with 10k. My initial buy in was at $3... a few weeks ago, I cashed out completely in the 40's. I think it still has some upside, but it really depends on the direction of the overall market. I'd wait til after the election before I made any big moves. |

|

Nice win there on Tamdem

They are a customer of my company but me personally I dont trade on my customers stock due to I don’t look good in Orange

if You French Fry when you should Pizza you are going to have a bad time

|

|

Administrator

|

This post was updated on .

In reply to this post by nepa

Wow nice! Nepa buying!?

I can't bet the farm, sounds like that was a garden for you. Maybe I should be more conservative but hey I was sure the next meltdown was coming at 18 or 20, so good thing that I'm not a timer. 800 pt drop today, not even in the top 10 things I am thinking about tonight. Am curious about tomorrow though.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

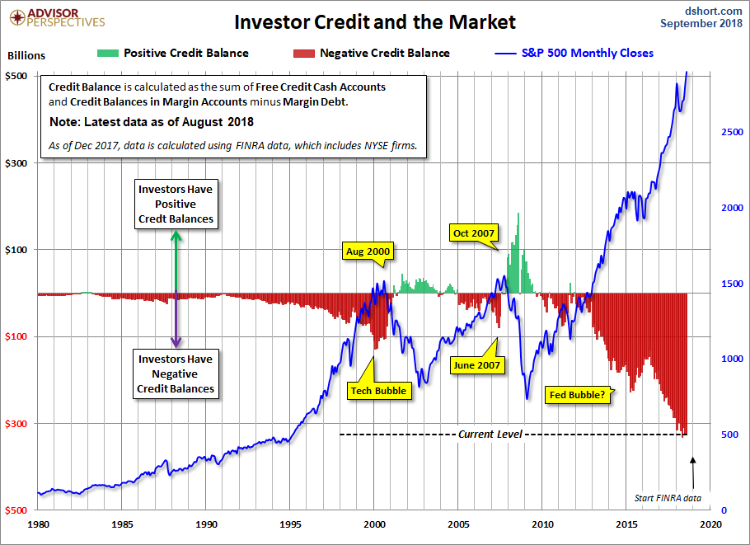

I tend to believe there will be a 10-20% correction from the high at some point in the next 2 years.

But I stumbled across this graph and it spooked me into thinking it might be a bigger correction:  This seems right to me:

|

«

Return to Off Topic

|

1 view|%1 views