Market Philosophy: What You Got?

1234567

... 34

1234567

... 34

|

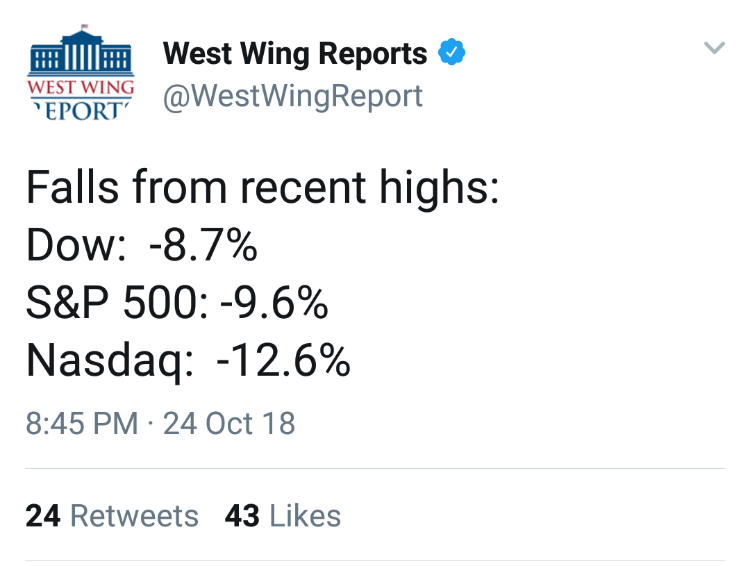

The episode this week was driven by the interest rates and for a while the flight to quality was not lowering bond yields which freaked the electronic trading out and drove more selling. That has resolved so all is straigting out now. Should see a bounce and we are. Could retest some support points though.

Time to buy.

if You French Fry when you should Pizza you are going to have a bad time

|

Have you read Flash Boys?

IMO: Guys like Brad Katsuyama should be running the show at the SEC. Unregulated front runners are putting everyone's equity investments in peril. It would be interesting to see what a flash-crash within the next few days would do to the broader markets. Good high-level explanation of "front running"

|

Re: Market Philosophy: What You Got?

|

In reply to this post by Z

I think I'm gonna switch from 60/40 stock/cash split in my new deposits back to 100/0. I'm finding it hard to figure out how companies aren't making tons of money in this environment (particularly banks). |

|

Administrator

|

How often do you make flips like that.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

Rarely (I think I've done it twice before).

And I never really move money out of one thing and into another... This is just a change in the allocation of the new money that goes in. |

|

Administrator

|

Got it. That makes sense to me. Why wouldn't you use Treasures vs cash for the 40%? Downside risk is pretty low. More than cash and not a huge return but some potential upside in a meltdown.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

I bought 1000 shares of GE today. It’s break up value is well over what it’s trading for now. The new CEO Larry Culp used to be head of my company’s former parent. He is the rare exception of a ceo that is actually worth what they get paid. He is going to turn it around.

if You French Fry when you should Pizza you are going to have a bad time

|

|

Administrator

|

This post was updated on .

I just checked out the chart. What has been the underlying cause of the drop in the last 20 years? The last 2 years?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

This post was updated on .

Everybody thought Jack Welch was a genius. He bought up other companies, cut everything to the bone and milked their reputations to sell product until with no R&D they fell behind the times and the spare parts business dried up through customers replacing their equipment with competitors products. He also had a "fire 10% of your workforce every year" policy that was really just an incentive for managers to fire the "older and therefore high paid employees" and replace them with college grads which decimated the knowledge base of the companies. It worked short term for profits and stock price but there was no long term plan. Everybody thought he was a genius. I thought he was just an ass. |

Immelt (the successor to Welch) was as bad, if not worse in my opinion. They're still in some deep doo-doo when it comes to forward looking liabilities. At today's level, there's looks to be more downside risk. JPM's Tussa has been 100% correct the entire way down... he called it a house-of-cards back when it was trading in the mid-20's. I'll buy in when he says they've bottomed out. |

Re: Market Philosophy: What You Got?

|

NEPA, What do u think of plug power (PLUG)?

I ride with Crazy Horse!

|

|

I agree GE has been greatly mismanaged. My take and it’s broadly been shared by analysts once it got below 10 bucks is that if you broke it up and sold it it’s now worth in the high teens. The new ceo Culp will sell some off and fix the rest. This guy is really good. buy low and sell high

if You French Fry when you should Pizza you are going to have a bad time

|

|

In reply to this post by ScottyJack

Scotty

Plug looks dangerous to me They just did a private placement of stock and as they are not yet profitable and are burning cash like a start up they will likely do it again. That dilutes the eventual earnings per share and those private placements get very favorable terms Something up your alley is to Look at eft MJ which tracks Pot market leaders. Risky but buying at a trough and has huge growth potential

if You French Fry when you should Pizza you are going to have a bad time

|

|

In reply to this post by nepa

Welch may or may not have been a genius but he was a good engineer who had an eye for value and ran a meritocracy until his later years when the company got too big for him to keep his hands around. There were lots of innovations in Healthcare, Engines, Power and Materials. Immelt was a nice guy and you know what they say about nice guys. GE has a lot of systemic problems that even good management can't help. I only hope for upstate NY they can keep it going.

Don't ski the trees, ski the spaces between the trees.

|

|

In reply to this post by ScottyJack

Currently no opinion. A quick scan of the financials shows that they are not too mired it debt. Revenue momentum appears to be trending in the right direction. I'll watch it and let you know if it looks like a Casino worthy effort. It seems a bit counter-intuitive. Hydrogen fuel cells as a replacement for batteries. Does this mean: When people are disappointed in the performance of their Tesla battery pack they can retro-fit their model 3 with a PLUG hydrogen system? At the current price, if the technology is a viable alternative, I would think they would be an acquisition candidate. |

|

In reply to this post by Z

There are lots of opportunities in the MJ market. The volatility is a like trader's wet dream. That said, I think it's too early make any long-term investment domestically in producers, processors or distributors. Unfortunately, there is still no legal storage of the capital within our federal banking system. I don't think changes in the federal system are forthcoming until we move away from the latest round of drug-demonization that has resulted from our nationwide problem with Pharma-dope. In WA state, you can buy weed with a credit card, but it must be done via a Bitcoin bridge. The vast of majority of the weed related transactions are still cash based. The hidden gems are in the safety/potency testing arena. There is still a lot of work to be done in this area surrounding legal weed. Just like any other consumable product, weed needs a potency/purity label before it can be sent to retailers. Companies that work with "dietary supplement" producers that are diversifying into the MJ cleanliness and potency testing are a fairly safe bet. |

Re: Market Philosophy: What You Got?

|

Cool beans bro!

I ride with Crazy Horse!

|

Re: Market Philosophy: What You Got?

|

In reply to this post by nepa

|

|

In reply to this post by Z

I hope your going long and planning on a DCA strategy. Tusa and the short sellers at JPM are going to drive it all the way down the toilet to $5. The balance sheet it a mess. I honestly don't think near-term liquidity is an issue, but their up to their eyebrows in debt. |

|

In reply to this post by ScottyJack

I'm not totally certain, but it looks like their about to turn-the-corner. Z noted the burn-rate, but I think they are now generating positive cash-flow excluding inflows associated with financing. If they show similar numbers next quarter and don't issue any more stock, then their not too far from sustained profitability. It's been in the doldrums for a few years now. I imagine the run-up associated with the IPO was driven by the Irrational Exuberance that was prevalent during the Greenspan era. Any idea what drove the price up back in 2014? |

«

Return to Off Topic

|

1 view|%1 views