Market Philosophy: What You Got?

1 ...

22232425262728

... 34

1 ...

22232425262728

... 34

|

WTI goes negative for the first time in history..

freak'n wheels are starting to come off people

"Peace and Love"

|

Re: Market Philosophy: What You Got?

Wild, right? Not sure the wheels are coming off though. Storage tanker business is way up. It's an event. We'll change, adjust, adapt, and move on to the new normal, just like we always do. |

|

As a first, I guess it’s not like other ratios or measures going one way or another tells us anything. Is there anything in history that correlates negative/decreasing WTI with market performance? MC, go find a graph!

We REALLY need a proper roll eyes emoji!!

|

Re: Market Philosophy: What You Got?

|

In reply to this post by Harvey

This was a bad idea |

Re: Market Philosophy: What You Got?

|

In reply to this post by JTG4eva!

Sorry, missed this one before:

|

|

Administrator

|

In reply to this post by MC2 5678F589

Well you are right, it didn't work. I was in the market for a lecture on index funds. I've forgotten why they are bad.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

Don't want to speak for him, but the people who usually say this believe that a lot of companies are bad, and the index fund gives you too many bad companies, so you might as well just pick good companies and invest in those. (I don't do this because it's sometimes very difficult to figure out which companies are good) |

|

Administrator

|

I like the lecture more when Z does it.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

You need your analysis with a side of George Soros conspiracies and complaints about "illegals"? |

|

Administrator

|

I don't pay attention to the garnish.

He's got a passion for the anti-index that you can't call up. I think it's because you are not a true believer.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

In reply to this post by Z

Meh, it was basically the same thing I said. |

|

Administrator

|

Not as compelling as hearing it from Z.

I'll put my lifetime trading costs up against yours any day. Pretty sure my answer is yes.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

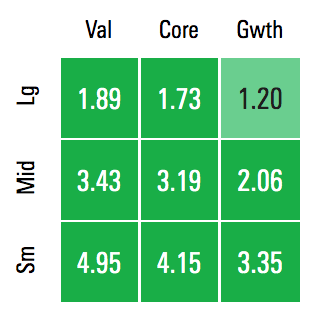

Ok Harv I'll engage with you here. This is the all time market to avoid index funds in - this is a stock pickers market. The S&P 500 is a stupid play because right now you would be buying pieces of all kinds of crap - materials and oil stocks, reits, etc etc ect that make up chunks of that index that are awful investments in the current investing environment. Below is the make up of the S&P 500 and the SPX fund around 45% of this is in markets that right now suck so badly on historically levels it is beyond belief - why would you want to own all that shit. Let's take health care for example - which is 15% of that index - fully 13% of that market is dead in the water as right now health care is 100% focused on covid and absolutely nothing else. Dont beleive me - try to go to the eye doc, dentist, or get your blood pressure checked or even get an xray. People are going to be dying of cancer for years after this that could have been deteched with a mamogram or other routine standards of care that have gone out to window. Portfolio Weight S&P 500 Information Technology 25.45% 25.48% 0 110 Health Care 15.37% 15.38% 0 110 Financials 10.92% 10.93% 0 110 Communication Services 10.73% 10.74% 0 110 Consumer Discretionary 9.79% 9.80% 0 110 Industrials 8.21% 8.22% 0 110 Consumer Staples 7.78% 7.79% 0 110 Utilities 3.56% 3.57% 0 110 Real Estate 3.00% 3.01% 0 110 Energy 2.65% 2.65% 0 110 Materials 2.43% 2.43% 0 110 Multi Sector 0.09% -- 0 110 Other 0.00% 0.00 I have bought some index EFT's in certain sectors that I think will outperform this year. Div stocks and Tech in particular though i check the div stocks to make sure energy is not a significant % Stocks to buy now are pure plays on covid and tech stocks that will benefit from work from home. I've turned over my whole portfolio except 3 or 4 stocks in the last 2 months and have done extremely well doing it. I bought GILD and cashed out already because i have concerns they will not be allowed to price the drug profitably or being forced to lisc it DXCM has been the top performer of all my holdings My one regret is deciding to not buy ABT as for trading costs I'm on a deal where i get free trades. Trading costs were a much bigger factor 5+ years ago when trading costs were much higher. Now they are practically free and your mutual funds still charge you a % of assets on an ongoing basis but on index funds it is pretty low i admit. In this market buying small #'s of superior stocks is the way to go unless you like index fund shit sandwiches.

if You French Fry when you should Pizza you are going to have a bad time

|

Re: Market Philosophy: What You Got?

|

I will agree with Z that the "trading cost" critique is no longer valid.

Trades are free on TD Ameritrade now. I'm loving it. |

|

Administrator

|

This post was updated on .

In reply to this post by Z

I'm not a big fan of the S&P 500. I like the total stock market best, but if I could add another, I'd add a total small cap.

When you say "suck so badly on historically levels" How far back do you go? I started buying index funds in 1988 and have never sold anything. Regarding trading costs, mine are zero over that time so I guess we are even on that one. I understand that there is some trading cost built into index funds, but almost by definition it's lower than an active fund. This could be an interesting test: Z pics 10 funds that he thinks are the best in the world. We test all ten against VTSAX for, not sure how long 5 years, or maybe 2 years. If two of his funds beat VTSAX he wins. Z I like when you explain your POV because you're a stock picker at heart and I just don't get it. To me the game is to see if you can end up with "enough" whatever that may be. No matter how hard I try, I don't see a safer approach than saving the max you can over 40 years and earning the market return. Your chances of having 10 million when you retire are probably greater than mine, but IMO my chances of having "enough" - whatever that is - seem higher than yours.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

I agree Harv. When you shoot for home runs every time at bat you strike out more than you hit home runs. Steady over the long run like the turtle and hare story.

The stock market is like people who go to the casinos. You only hear about the wins. Seems like no one ever loses. No offense to Z. If that's your thing and you're not playing with the whole bank, have fun. I do play around a little myself but it's not much money at all. We all have different tolerances for risk. |

|

If this true, even though I'm against raising taxes, most of these folks made their multi-billions on an internet without much if any "sales tax".

Might be time to have them "pay" an appropriate amount of $ instead of pocketing the $. Maybe they'll just move $ to a "tax haven" the old fashion way. Who knows, I don't know much about this ecomedy. https://twitter.com/public_citizen/status/1250417340992434176 |

|

Administrator

|

This post was updated on .

In reply to this post by Z

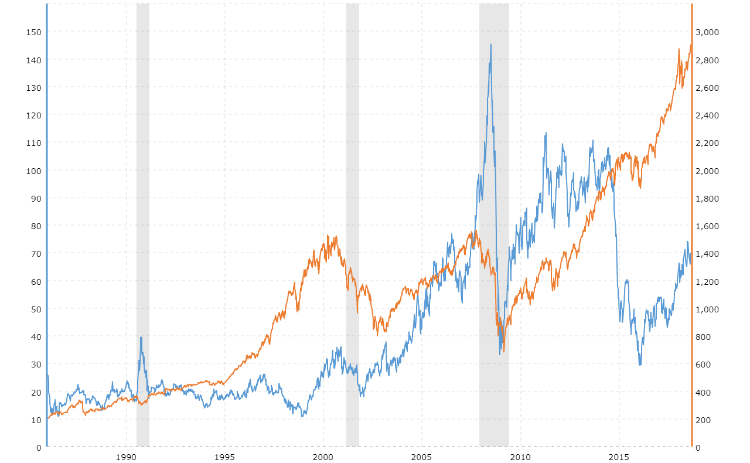

The correlation between small and large seems to be looser than I remember. Not saying one day means anything...

How to see this longer term?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

In reply to this post by Harvey

My non equity portfolio is managed by a fixed income pro. That is my “enough” to retire. The equities I handle myself is the whipped cream and cherry on top for retirement.

The way to look at this is this market right now only has about 5 to 10% winners. The other 90% are going to suck on an unprecedented scale. Owning the whole market for this yr means you are guaranteed to lose a crap ton of money. My 10-15 stocks I own in the are going to outperform indexes being the best firms in the best industries for this current fed up situation. In normal times a couple years ago I’d agree the whole market approach made sense to assure a long term average return with less risk. When we got to the market top at the end of the Bull run last yr stock picking became superior and now it is not even close. Your safety play is a guaranteed loser this year. If you dollar cost average it will play out fine in ten years but I’d rather make money to recover the drop we all took in March then continue to move more of my winnings to my fixed income manager to add to the safety side of my portfolio.

if You French Fry when you should Pizza you are going to have a bad time

|

|

Administrator

|

We have a winner. Nice work. So this is fun for you after your retirement is set. All good. This is the difference between you and me. One year means very little to me. I'm thinking I have to plan for the next 20-30 years, minimum. I only lose a crap ton if I sell. If you are saying that your 10 stocks or funds have a 50/50 shot to beat the index in the next six months, I might agree with you. For me the best long term strategy is to try to maximize my earnings at work and cut my costs while continuing to save. I will DCA as I always have, as long as I have a paycheck.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

«

Return to Off Topic

|

1 view|%1 views