Market Philosophy: What You Got?

1 ...

25262728293031

... 34

1 ...

25262728293031

... 34

Nope. I just had to sign off that I was an idiot.  I mainly did it to purchase EFTs with lower expenses vs the funds available in the 401k. Eventually, the last 401K included low cost funds and more choices. |

|

In reply to this post by JTG4eva!

Up until a couple years ago I was like 90% in stocks. Thankfully I changed that before this mess My individual stock portfolio is alway less than 25% of my total. Right now it’s a bit under 20% Another 30% is in stock mutual funds of which indexes and index sector efts are like 5% 50% is run by my financial advisor and is in bonds ladders and other lower risk assets My advisor is comfortable with me being aggressive with that stock portfolio since it’s balanced by the lower risk side and I don’t go over 2.5% of total in any one stock I’m 54 so my balance is important If I was in my 30s that dip was the buying opportunity of a lifetime. I would have been all in

if You French Fry when you should Pizza you are going to have a bad time

|

|

Mutual funds vs. index funds...in the context of the discussion of individual stocks vs funds are they all that much different? Mutual funds are actively managed and someone is picking the stocks in the fund, but the intent is to diversify to reduce risk, which also limits potential returns (vs. picking individual stock winners).

We REALLY need a proper roll eyes emoji!!

|

|

Index fund proponents would say an actively managed fund is higher cost and that is true

Right now though an index can’t avoid the flaming piles of garbage stocks like airlines restaurants hotels etc Actively managed mutual funds can more easily avoid companies with poor Covid exposure and buy Covid winners It is worth the diffferent you pay in fees of a half percent Large caps are also going to strongly out perform small caps in this environment If you buy Harvs full market index you get lots of small and mid cap exposure which is not a good thing for the foreseeable future

if You French Fry when you should Pizza you are going to have a bad time

|

Re: Market Philosophy: What You Got?

If small & midcaps are struggling, they'll get bought by larger players (that are flush with cash), usually at a premium to their stock price at the time. I don't think it's bad to own small & midcap funds (they make up about 18% & 11% of my holdings). |

|

Administrator

|

This is prudent IMO. Especially now. The biggest issue with indexes in my view is the underweighting of small and mid caps. That's why the most basic portfolio should include at least three funds to add diversification: VTSAX VSMAX or VISVX VBTLX If you want to diversify further: VGTSX VGSIX VIPSX OK Z let me have it!

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

Administrator

|

In reply to this post by Z

Definitely sell all that right now!

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

Administrator

|

In reply to this post by Z

That's pretty awesome if you feel set at 54. Congrats.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

In reply to this post by MC2 5678F589

I happened to have my quarterly review with my advisor yesterday

His advice that I fully agreed to is under weighting small cap is the smart move right now They will have a harder time raising funds to survive

if You French Fry when you should Pizza you are going to have a bad time

|

Re: Market Philosophy: What You Got?

Some might go under. Some might thrive. I'm not worried. I have a long time horizon and a pretty good amount of money saved for a 39 year old guy. Just refinanced my house down to 15 years, too. I'm stress free.... Especially if Trump agrees to fund this: https://www.vox.com/2020/5/12/21254397/next-coronavirus-stimulus-package-democrats-heroes-act |

|

You are younger than me so you can afford to be more aggressive and if you have some losses you have a bigger window to recover than me

Smart move MC refi at these crazy low rates Paying your house off in your mid 50s really sets you up for retirement well. Congrats on a good plan

if You French Fry when you should Pizza you are going to have a bad time

|

Re: Market Philosophy: What You Got?

|

|

While it’s trending up I’m having a hard time with how much the market is coming back up

So far the indexes have held up but that can’t happen much longer with the crappy earnings Big bubble is brewing with 5 stocks making up for 25% of the qqq and S&p 500 that means the others are not carrying their weight And the house of cards will come crashing down

if You French Fry when you should Pizza you are going to have a bad time

|

|

Administrator

|

By how much is your 10 stock portfolio beating VTSAX?

Since May 8 and/or March 25.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

In reply to this post by Z

Agree. I think we're in for a reckoning here. It just doesn't seem like the stock market guys are understanding the ripple effects that will come from people staying home and not spending on travel, restaurants, bars, etc. |

Re: Market Philosophy: What You Got?

|

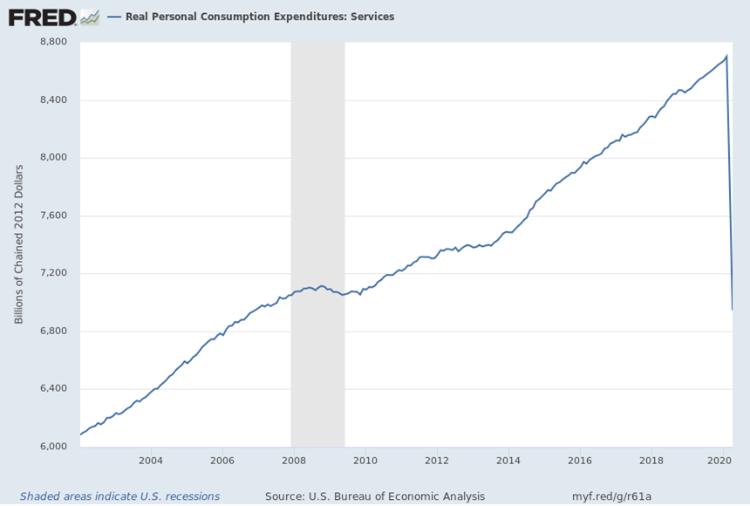

Incredible drop in spending on services. Not great for a service economy.

|

|

Administrator

|

With portfolio recovering all but 5% from the all time high, it probably makes sense to move to that 50/50 I've been thinking about (from 60/40) but I just can't do it. At this point it's against my dna.

Another thing I've been thinking about is the "target retirement" fund we are using. Probably makes sense, on retirement to break them out into the individual funds, so withdrawals can be managed more effectively. Z how is the comparison between VTSAX and your 10 fund portfolio looking?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

I'm not sure about what to do with this chart. Does it mean that people are keeping a lot of money on the side, and are willing to spend it when they are able to? Or does it mean people are nervous as hell about how the next few years will shake out, and are saving money because they are anticipating a few years of lowered wages:

|

|

Yes

"You want your skis? Go get 'em!" -W. Miller

|

Re: Market Philosophy: What You Got?

|

Personal income up 10.5% in April:

https://www.bea.gov/news/2020/personal-income-and-outlays-april-2020 |

«

Return to Off Topic

|

1 view|%1 views