Market Philosophy: What You Got?

1 ...

24252627282930

... 34

1 ...

24252627282930

... 34

Re: Market Philosophy: What You Got?

|

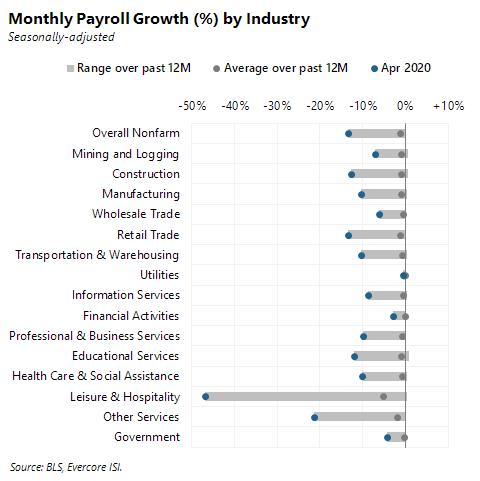

Latest job report out. Unemployment up to about 15%. Not great (stock market up in anticipation of more stimulus):

|

|

Administrator

|

In reply to this post by Z

You got me 100% backwards I think. I was saying yea maybe Z is right about me being too aggressive. Maybe cut my losses with the dead cat bounce, and move further away from stocks. I just can't do it. I never sold anything, not starting now.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

Administrator

|

In reply to this post by MC2 5678F589

Not a surprise to me, unfortunately.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

Administrator

|

In reply to this post by MC2 5678F589

I'm pretty sure the market requires speculation to function. If everyone was 100% in index funds the system would have to crash right?

I acknowledge the conundrum.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Index funds are essentially socialism applied to the securities markets. A rising tide floats all boats. What makes that tide rise is the prospect of future earning increasing. But in this case earning are not rising across the board and in fact are declining for 90% of companies so if there was only index funds right now the market would indeed be crashing.

if You French Fry when you should Pizza you are going to have a bad time

|

Re: Market Philosophy: What You Got?

Is this true? Source? And the question isn't "are earnings rising at this very moment?", it's "how will the company do with future earnings?" and "am I willing to pay $x (where $x is 20% or so below January's price) for a tiny piece of those future earnings?" |

|

Administrator

|

I'll grant him that. Probably not 90%. But many are shut down, some are doing as well, some are making a killing.

The real question for a market timer is: Can I get one of those winners at a price where the upside isn't already factored in? We should remember to check your stocks performance vs VTSMX in... how long Z? What is your time frame for the stocks you bought?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

Man, this is one informative thread. Valuable insights.

"You want your skis? Go get 'em!" -W. Miller

|

|

In reply to this post by Harvey

So many companies are withdrawing thier forward guidence it is almost impossible to tell what % - it is very high % that will have significantly lower earnings in Q2 and Q3 yoy.

it also is very difficult to find pure plays that are Covid + without some significant segment of thier business being Covid minus. Resmed makes respirotors huge plus but also makes sleep apnea equipment which would be a minus. Roche has so many fingers into Covid - 3 tests plus more in the works, vaccines and therapy drugs that I think they are one of the best Covid plays. Abbott has a bunch of positives but way more negatives in devices that are considered non essential parts of medical care that have been basically shut down for 2 months. I have 25 plus years experience in the medical device space so that is one area of the market i do well in. As to my time horizon on stock buys it normailly is a year to years and buy and hold but currently I'm way more reactive to protect my principle and opportunistic to jump on a better stock. I have some stocks that I'm up around 10% in that I'm considering selling if I can find a better path to higher gains. I also holding much higher cash amounts that i have in the past.

if You French Fry when you should Pizza you are going to have a bad time

|

|

In reply to this post by Harvey

go look at the stock charts of my 10 vs VTSMX I just did I'm now even more of a happy camper I sold out of my old holdings the end of Feb thru the first week in March when the VTSMX was in the mid to high 70's. It is at 70 today. Bought most of my new holdings down at the bottom. I get it Harv you are extremely risk adverse as well as adverse to make the wrong any move weather it is buy or sell and your horizon is forever. You are following a method that works for you. If i was like that I would bury my head to any and all news about the market and just stay on course. My goal as i mentioned is to become gradually more risk adverse as I age to the point where in retirement I could afford to be on autopilot with income generating holdings except if i decide to keep a small equity portfolio for fun. I'm following that path - 5 years ago I was 100% in equities now i sleep better at night an approach I'm comfortable with. if you guys like index funds great have at it but just understand that with that user friendliness of a VTSMX you are owning a sack that is well more than half full of garbage right now. The best index funds you can buy now are the Dividend indexes as they will outperform the market as a whole given what bond yields are.

if You French Fry when you should Pizza you are going to have a bad time

|

|

Administrator

|

What's your time frame? You're happy, so over what period are you evaluating?

I don't think anyone has really defended index funds here, except maybe me. Also when I say "index funds" I'm being lazy. It's shorthand for low cost, diverse, slow moving mutual funds, from well established companies. Vanguard among others. Sorry Brownski.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

Z, the 10 (hopeful) winners making up your “well picked individual stocks right now will beat the index/mutual fund lackeys” strategy only represent 15% of your portfolio. What is the other 85% invested in?

We REALLY need a proper roll eyes emoji!!

|

|

I will say, this discussion is interesting....but probably pointless for some. If a person’s investment nest egg is in a company 401(k) or some other IRA type account that doesn’t offer an option to invest in individual stocks....they wouldn’t have the option to employ the Z-strat, not unless they want to pay the penalties and taxes required to free the money up for other investments, no?

We REALLY need a proper roll eyes emoji!!

|

|

Administrator

|

This post was updated on .

Buying individual stocks seems like work to me, 401k is easy.

Z likes it, I get it, it's fun for him. Do you make those moves in a taxable account?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

Why not? Is there some rule that you can only own stock if it's in a retirement account? I do a bunch of gambling with income that has already been taxed. What's wrong with buying stock & collecting dividends outside of retirement accounts? |

|

Administrator

|

This post was updated on .

Just curious. Not accusing anyone of anything.?

Pretty sure many 401ks won't allow that much movement.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

You can have a brokerage acct within a rollover ira

If you trade in a taxable account you have to worry about short term vs long term capital gains taxes impacting when you sell

if You French Fry when you should Pizza you are going to have a bad time

|

|

In reply to this post by Harvey

The 3 different companies I worked for over the years all allowed stock trading in my 401K. |

|

The two retirement/401(k) accounts I’ve saved in don’t provide an individual stock trading option. Like a said, moot convo for some people, unless they have multiple accounts. Given how many people don’t have much of any retirement savings, how many do you think have multiple accounts?

Nothing wrong with having investments in more than one account, including taxable accounts. Did someone imply that there was? Making moves in a taxable account does require more planning. College money for my boys is not in a tax deferred account, and all trading options are open to me. I trust my advisor on that one, and we’ve made some adjustments to the account, which does include some individual stock...but like Z, that’s a relatively small percentage of the portfolio. He hasn’t, however, advised putting the bulk of the money in individual stocks. Too much on the line to gamble it all on individual investments. Still curious where Z has the bulk of his investments. 15% is tied up in the Z-strat, could the rest be in.....mutual/index funds?

We REALLY need a proper roll eyes emoji!!

|

|

Administrator

|

In reply to this post by x10003q

Did they limit your trading?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

«

Return to Off Topic

|

1 view|%1 views