Market Philosophy: What You Got?

1 ...

10111213141516

... 34

1 ...

10111213141516

... 34

Re: Market Philosophy: What You Got?

I'm getting a bit nervous up at these prices. Wall Street is pricing in a 100% probability of a Fed cut at the end of July, but I'm not convinced that's what the Fed will do. June inflation numbers popped up a bit, and low unemployment continues. If the Fed chooses not to cut and the market tanks 1,000-1,500 points, I've got some gambling cash ready. |

|

You sounding like Z

Don't ski the trees, ski the spaces between the trees.

|

Re: Market Philosophy: What You Got?

|

You think the Fed will cut?

Also, I recognize that the gambling I would do is, in fact, gambling and not some insane beat-the-market strategy wherein I assume that I know what is going to happen at any given point in time. |

Buy low, sell high, isn't really gambling, is it? I mean, lots of (wealthy) people with cash buy after major market declines. |

|

Administrator

|

Lots of regular people do too.

Actually my method is a little different. Buy all the time, never sell.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

In reply to this post by Marcski

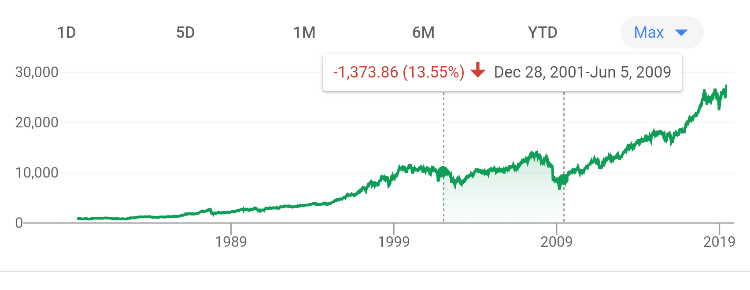

Yeah, but there is no way of knowing what price is low and what price is high at any given time. So it's still gambling. Like if a guy thought that he was timing the dotcom burst right by buying in December, 2001, it turns out he would have been better off holding cash and waiting for 8 years before putting his money in (assuming no dividends):  But since there was no way for anyone to know that, the Harv strategy of "keep buying and never sell" works fine for most of us common folk. I'm just trying to squeeze a bit more juice out of the orange (even though most studies say that people who attempt to time the market usually end up in worse shape than people who just leave their money in - I figure there's no harm in strategically putting my money in). |

|

Administrator

|

Theoretically if you buy all the time (and spend the same amount each week) you should end up with a greater percentage of shares that were bought a little bit lower than average.

Actually the real Harv method is probably: Keep buying for 45 years. Buy mostly stock for the first 35-40 years. Then rebalance to a go to a 60/40 split with existing assets, but keep buying. New money at 50/50 or 40/60. Then when you retire, (year 45?) sell what you have to to live. Hope for a long life without lots of expensive illness. In retrospect my rebalance (step 3) wasn't ideally timed (about 2-3 years ago) but wasn't that bad either. I was feeling old and the risk of 95/5 was too much.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

In reply to this post by MC2 5678F589

Fed chose to cut, but it looks like everyone is disappointed that they didn't cut more. After today's 700 point plunge, that puts it in the 1,000 to 1,500 point range that I targeted. I bought a bit back today. Pretty amazing that stocks have barely budged from December 2017. |

|

If Hong Kong implodes , then what ??

Tricky times

"Peace and Love"

|

Re: Market Philosophy: What You Got?

|

It is tricky.

Do you buy in an environment where inflation is low, companies are pretty much minting money with a historically low tax rate, wages are (slightly) up, and the risk of Fed overreach makes future inflation more likely? Or do you hold off, thinking this trade war will go on for at least 15 more months, we might be in for more shocks, a global economic slowdown might drag down the economy of several countries, and the people who are struggling in this environment continue to struggle? Interesting times. |

Re: Market Philosophy: What You Got?

|

I just read a statistic that said that, since 2009, when the S&P drops more than 3% in one day, if you look 6 months later, it has been up above that level 96% of the time.

I realize that "since 2009" isn't a huge sample size. But wow. Warren Buffet is holding a lot of cash right now. He's probably not "buying the dip" every time the market drops. I'd imagine that he's waiting for a big drop. |

|

Administrator

|

Any idea how many times that 3% drop happened? That's a big drop.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

In reply to this post by MC2 5678F589

Given the current state of things, I think we need to consider the possibility that the market will not exceed its recent peak for a long, long time. I think things are going to get a whole lot worse. I was planning on cashing out some 401k money to pay off our split mortgage that has a really high interest rate. I want employment flexibility so I can take lower paying jobs that I would enjoy more. Any ways, I started thinking about doing it last week... but clearly missed the window. Still considering it even after this drop but I am hoping for a rebound first. I honestly wonder how big this drop is going to be... I think it could just be getting started if... well, politics.

-Steve

www.thesnowway.com

|

Re: Market Philosophy: What You Got?

Yeah, but you have to consider that the stock market & economy are priority numero uno for this administration. If they can't deliver stock market returns for their rich donors, honestly, what can they hang their hat on going into the next election? People are okay with a lot of bullshit, but they will not tolerate losing money (see: 2008) |

Re: Market Philosophy: What You Got?

As does every administration Don't kid yourself |

Re: Market Philosophy: What You Got?

|

I mean, other administrations do things like "attempt to fix the healthcare system", "make overtime rules for workers more fair", and "pass tax cuts that help middle class workers instead of rich people & giant corporations", but I guess they're capable of doing two things at the same time because:

|

|

Administrator

|

In reply to this post by riverc0il

I also feel pretty confident we are at or past a top. But I can't bring myself to act on it.

I'm sticking where I have been for the last two years: 60/40 with new contribs at 40/60. If the market drops 5 or 10,000, I'll do new contribs to 60/40. That's as market timey as I get.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

In reply to this post by MC2 5678F589

THAT is exactly what scares me. They are playing hardball and chicken DESPITE the economy already being amazing and a bad economy being the kiss of death in any election year. Motivation is one thing, knowing what buttons to pull or not to pull is another. A strongly motivated administration can pull all the wrong levers trying to make things better and really mess things up... these guys don't exactly have many major economists on their side regarding their policies...

-Steve

www.thesnowway.com

|

Re: Market Philosophy: What You Got?

Some things are more expensive, some things are less expensive. We had tariffs before Trump. He's just fucking around with the levels on different things and making shit a lot more expensive because he (stupidly) thinks that will make companies come back to the US. What it's really doing is creating uncertainty, which is something that partisans complained about in the last administration, but seem to have fallen eerily silent on now. Every week it's another dumb threat, then a stock market bounce after he pussies out and announces a "deal" that always turns out to be the exact same as the status quo. They're not going to actually change anything significant. Why would people who are fantastically wealthy (Trump & Xi) do anything that would affect that in any way (except to pass laws like the Tax Scam to make themselves richer)? It's all a fucking act. The real question is: how much money is Trump making by betting on the VIX before he sends his stupid tweet threats? |

Re: Market Philosophy: What You Got?

|

Some are obsessed with politics and will bring it up at any give chance

|

«

Return to Off Topic

|

1 view|%1 views