Market Philosophy: What You Got?

1 ...

12131415161718

... 34

1 ...

12131415161718

... 34

Re: Market Philosophy: What You Got?

You're a real dummy. The only thing people have to do is scroll back a few pages in this thread to see your idiotic stock picks & timing (GE!!) Maybe you can go with your (stupid) strategies and let me find the balance that works for me? Ignoring 92% of the world's population by investing only in American Businesses that do business in America seems pretty dumb to me, but you do you. |

Re: Market Philosophy: What You Got?

|

In reply to this post by Z

The hard part about talking to idiots is that they *almost* get it, but they never seem to hit the right conclusion. Hey Z: what happens to our exports when our dollar and our goods become more expensive to world markets? What happens to our imports when the products that every other country makes are (relatively) cheaper? |

|

Administrator

|

In reply to this post by Z

I think? you guys have completely different time frames.

MC are you a buy and holder? Z sometimes you do a round trip on a position in a few weeks? If you are in it for the long haul, buying battered can work.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

|

In reply to this post by Z

I'm no financial guy, but if you're in for the longer haul, wouldn't you want to use the high dollar to acquire more shares, then sell those shares when the dollar goes down?

Sent from the driver's seat of my car while in motion.

|

Re: Market Philosophy: What You Got?

This seems right to me, but Z seems to think that he has all the answers |

|

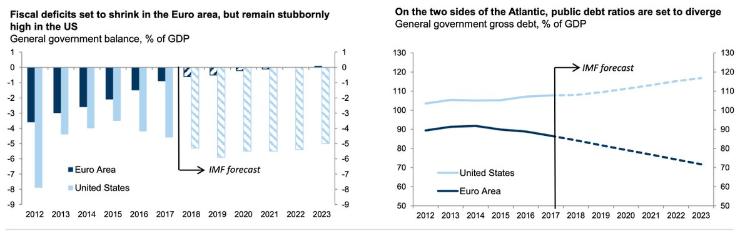

This currency thing is not going away anytime soon given the differences in the bond yields in the US vs Europe and Japan. Foreign money will be pouring us treasuries and large cap div stocks.

The China issue could get resolved eventually with a trade deal. Personally I don’t ever invest in China as their Govt and cronyism makes their market not very transparent. If the trade issues get resolved I will buy US companies doing business in Asia. MC if you read what I wrote I’m looking at where the end markets of stocks I buy are. It’s been much better to focus on companies that get most of their sales and profits domestically the last couple years as we have the strongest economy. You are an Idexx fund guy so you can’t really do that but it’s working well for me. It just takes more work. I made a 5 grand bet on GE which is small and it didn’t pan out. I’m happy I sold with a small loss as they have become a shit show lately. As in index fund investor you today likely own way more GE than 5 grand. Chew on that.

if You French Fry when you should Pizza you are going to have a bad time

|

Re: Market Philosophy: What You Got?

Why would foreign money pour into U.S. Treasuries when our economy is built on debt, while European economies are more financially stable?  You're a big "our debt is a huge problem" guy. Why do you feel like our debt is not actually any kind of problem now and that it will actually help us by offering foreign investors higher yields? Every trader seems to know this, which is why none of them are truly worried about a long term trade war & the market remains fine. I'm fine with this. I heard that the liquidation value is somewhere around $13.00 a share. It's trading at what, $8.50 now? I might buy some for the personal account soon. |

|

Administrator

|

In reply to this post by Z

I looked into VTSMX (Vanguard Total Stock Market Index) and didn't see GE listed in the top 100 companies that make up the index. Number 100 was .2% of the total market cap.

If GE was Number 101 and also .2% of the total, you'd have to own $250,000 of the fund to have $5000 of GE.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

Re: Market Philosophy: What You Got?

Chump change for Z, I'm sure. But yeah, if I have less than that & 30% is in international stocks, I'd imagine that I don't have even close to $5000 in GE, which, as I said, wouldn't be awful. |

Re: Market Philosophy: What You Got?

|

In reply to this post by MC2 5678F589

I took out a mortgage at just over 3.5%, it's even lower today, yet European Central Banks are lending at negative interest rates. I think I read that a bank in Denmark was offering negative interest mortgages. (In Russian Accent) Buy House And BANK PAYS YOU!!) As ridiculously low as US yields are, where else are you going to go for risk free investing? (Unless you believe we're going to default - whole topic on it's own) |

|

In reply to this post by MC2 5678F589

Money flows to high yield with low risk. That is the US economy right now.

If you want to risk 30% of your assets on socialist leaning economies go for it. You at least are putting your money where your mouth is. The US is the best bet. You have a longer horizon to index off of the lower market I don’t. In a 10 yr horizon I’m making a safer bet which is also likely going to out perform your world index allocation. Good luck with that. I’m out again for awhile because arguing with an idiot is really just not worth my time or effort

if You French Fry when you should Pizza you are going to have a bad time

|

|

Administrator

|

Z you retiring in ten years? You look younger than that bro.

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

I’m 53.

I’ve done quite well in the market and have a strong advisor and plan to be out in 10 but I really love my new job I started in January so we will see as I’m having fun again working. I feel like the prev 3 years with my old company aged me 10 years. I’d like to be skiing and golfing full time while I can still physically enjoy it Need to get my son thru Northwood ski racing and college first and then see how it goes. The kid would need to get a job and his own health insurance. I’m going to make a pledge to just ignore everything the idiot posts despite how ever many inane charts and graphs he trots out so I can stay active here Harv.

if You French Fry when you should Pizza you are going to have a bad time

|

Re: Market Philosophy: What You Got?

|

The Dunning-Kruger effect is strong in this guy.

|

Re: Market Philosophy: What You Got?

|

In reply to this post by campgottagopee

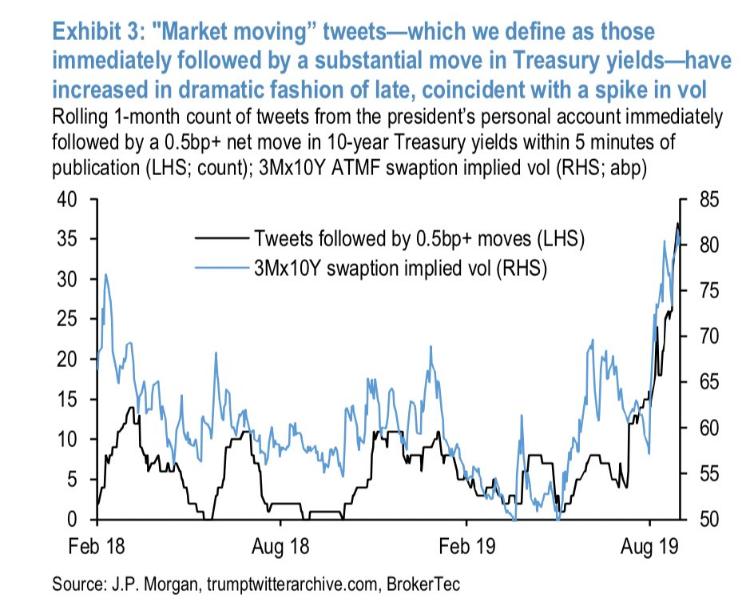

https://www.investors.com/market-trend/stock-market-today/stocks-tumble-trump-slams-china-tweet-storm/ |

Re: Market Philosophy: What You Got?

|

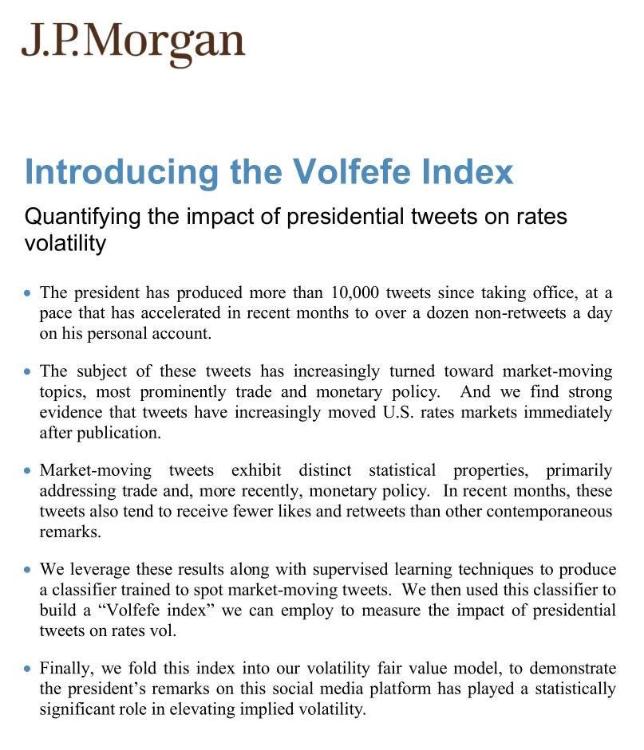

JP Morgan seems to think Trump tweets are moving the market:

|

|

Administrator

|

Can someone explain what it is the NY Fed(?) is doing overnight to improve the liquidity of... what?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

In reply to this post by MC2 5678F589

One of my favorite studies |

|

In reply to this post by Harvey

There must be some banks unable to get overnight lending or some banks who do not want to lend overnight. |

Re: Market Philosophy: What You Got?

|

In reply to this post by Z

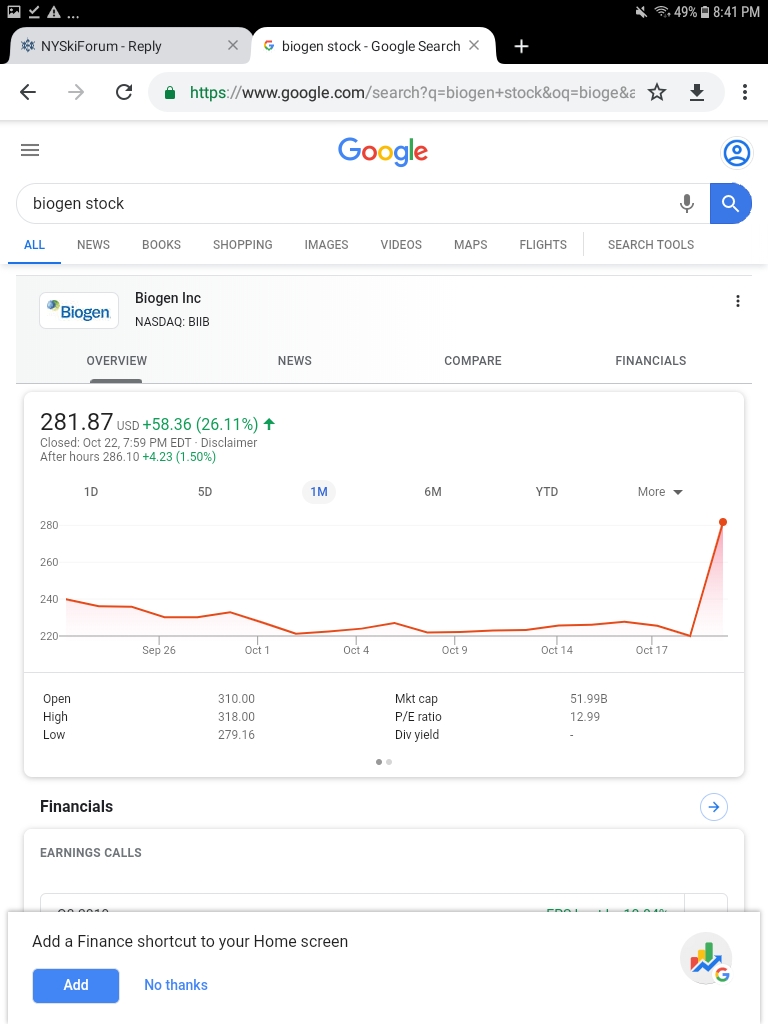

Anybody get in on Biogen?

I don't rip, I bomb.

|

«

Return to Off Topic

|

1 view|%1 views