Retirement Dreams

12345

... 9

12345

... 9

|

I like Bend a lot but it would be better for MC than me given it’s a very blue state

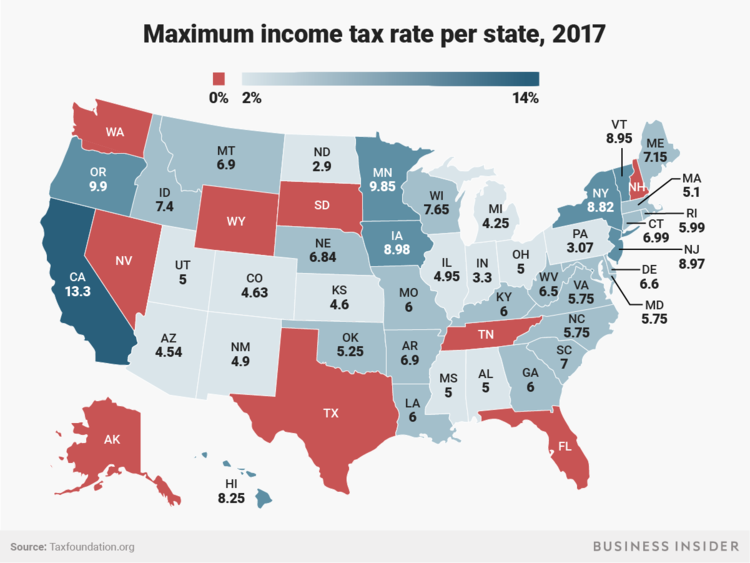

I need a nice Red state with low or no taxes UT, ID or WY. I really can’t see a future to retire in NY where withdrawals from the retirement acct will be heavily taxed.

if You French Fry when you should Pizza you are going to have a bad time

|

Pensions and IRAs are fully taxable in UT and ID. Social Security is also taxable in UT. Pensions, Social Security and the first $30K of IRA withdrawals are not taxable in NY. WY has no income tax at all. mm

"Everywhere I turn, here I am." Susan Tedeschi

|

|

We keep talking about a move, I would like to move we’re the property tax is lower and the skiing is better, my wife wants to stay near the kids and grandkids and so do I so we have stayed put. When you look at the cost of selling and buying and moving it would take a number of years to recover those costs. Water out West is a big deal and we take it for granted here in NY. I get very dry skin in arid climates, my hands will crack and bleed. I experienced this the times I lived in the west. So I think we will stay put. We are now planning a huge renovation to the house, one that will accommodate as we begin to be less mobile. I don’t blame those living outside the city for wanting to get out.

Don't ski the trees, ski the spaces between the trees.

|

|

my wife and I talk about moving to a lower tax state. property tax is Rockland in crazy. we pay almost 15k/year..

with the house almost payed off , where else could we live for 1200/month... And she also wants to be near the kids , who will most likely end up in NYC..

"Peace and Love"

|

|

In reply to this post by Milo Maltbie

I think you can also manage your tax liability pretty effectively based on your expense management plan. If you keep expenses low, you can draw smaller annual amounts therefore minimizing your tax bill. It get's a bit more complicated once you reach 70.5. Then you're in the Mandatory Required Distribution zone. I forget the required annual amount, but if I recall correctly, it's based on your total account balance on 07/31 in the year prior to attaining age 70.5. Most people don't have enough saved to see any real tax issue. If you have a 7 or 8 figure balance... then it would be a different story. |

|

In reply to this post by JasonWx

I’m sure where our kids settle will be a factor in our retirement choices.

Plan....we don’t really have one. My wife is looking to take her NYS Teacher’s Retirement almost as soon as she can. I’ll try and convince her to stay a bit longer to max her pension, and I’ll work as long as I can. No pension on my end, but a few good years of earning after the kids are out of college will allow us to pad the nest egg nicely. My wife loves Cape Cod. I’m thinking sell the house here in Dutchess Co. and retire to the condo we have on the Cape. Unless our kids settle in the lower Hudson Valley there’s no need to keep paying the property and school taxes, which are ten times what we pay on the condo in Chatham. As for age.....recovery from injury is much slower at 50 than it was even a couple years ago! I’ll keep on with my skiing exploits, although I’ll dial back my level of aggressiveness I’d imagine. Not that I’m ever stomping crazy shit, but I’m sure that 15 years from now my body will be a wee bit less risk tolerant than it has been. I could be content with not searching out the more difficult stuff at new places, and enjoying the plethora of low angle beautiful backcountry that’s out there. I’d love to show the wife some of the cool mountain locals I’ve gotten to. Other than that a little international travel, and lots of long walks on the beach. Maybe, if we are lucky!

We REALLY need a proper roll eyes emoji!!

|

|

We plan on staying right where we are with WAY more time spent on a beach

|

|

In reply to this post by PeeTex

Taxes are manageable but grandchildren and climate are non-negotiable. The east coast climate is better for me, especially close to the coast. The dry air out west is bad and the elevation is worse in the mountains. I'd like to live somewhere I could mostly walk for most simple errands. I'm thinking Saratoga Springs but I may be priced out of that. I knew a guy who retired to Troy, which mystified his family but he was thinking the same way I am. mm

"Everywhere I turn, here I am." Susan Tedeschi

|

|

In reply to this post by JTG4eva!

If you think 50 is bad, just wait. mm

"Everywhere I turn, here I am." Susan Tedeschi

|

|

As long as we're dreaming....

I plan on winning the lottery as well

|

|

In reply to this post by Z

Eastern Oregon and Washington are not blue at all. It's not about the state. Rural areas are conservative and cities are liberal. Ski towns are mostly liberal in a libertarian kind of way. If the Dacks are too liberal for you, you'll probably need to move rural Idaho, or a ranch in the desert somewhere. mm

"Everywhere I turn, here I am." Susan Tedeschi

|

|

In reply to this post by nepa

The first year mandatory distribution is the balance on the previous December 31 divided by 27.4. THe divisor decreases by about 0.9 every year. In NY, the first $30K is not taxable, and it's not taxed at all in some states. Property tax is actually a bigger issue, especially since the deduction is limited now. Every place I want to live, in a city or a waterfront property, is going to have high property tax. I think it's going to come down to a choice between living in the perfect place or traveling more. mm

"Everywhere I turn, here I am." Susan Tedeschi

|

|

Administrator

|

I had no idea. To be clear the feds tax it in every state like regular income. What are the state tax rates?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

if You French Fry when you should Pizza you are going to have a bad time

|

|

Administrator

|

So does this mean if I withdraw 31,000 in year one I would pay 9% of 1000 in state income tax? How does the word "maximum" come into play?

"You just need to go at that shit wide open, hang on, and own it." —Camp

|

|

This post was updated on .

In reply to this post by Z

That map doesn't tell the whole story. The ID income tax is 7.4% for incomes over about $20K, and they tax pensions and IRAs. NY doesn't tax pensions, and the rate is less than 7% until you get to $2 million. I don't expect to crack $2 million in retirement unless my IRAs do WAY better.

OTOH NY property tax can be off the charts. mm

"Everywhere I turn, here I am." Susan Tedeschi

|

|

https://www.cnbc.com/2018/04/10/us-states-with-the-highest-tax-burdens.html

NY has the highest state tax burden in the country considering everything

if You French Fry when you should Pizza you are going to have a bad time

|

Not necessarily for retirees, especially Upstate. NY income tax is pretty minimal for retirees. Upstate property taxes are variable, but not as bad as downstate. Better to decide where you want to live and manage the taxes than to live somewhere you don't like because of the taxes. mm

"Everywhere I turn, here I am." Susan Tedeschi

|

|

In reply to this post by Milo Maltbie

There is always Türkmenistan. I’ll probably stay in NH, but move out of downtown to the sticks. Smaller house with hopefully little maintenance. As someone who lives in one of those red states on the map......they’ll get their $ from you one way or another. |

|

In reply to this post by Milo Maltbie

MM is spot on here. I live in Eastern WA. If you exclude Seattle and Bellevue, it's pretty much a red state. It's mostly agriculture over here. Much of the conservatism is pretty traditional, as opposed to the propaganda driven bullshit that has infected our modern political reality. There is some Trumpism over here, but it's mainly found in the extreme rural areas. Z. I think you'd like it on this side of the Cascades. There is no state income tax, ultra-cheap electricity, and our property taxes are quite low. Legal weed has even lead to a couple of reductions over the past few years. I nearly fell over when I saw Jason's tax bill... I live in a fairly large house, and have never paid more than 4k annually. 15k seems almost unconstitutional. Z. Off topic, but I'm curious, as I know you work in the medical device arena. I think you and I probably share a similar level of financial awareness. Perhaps this could be a good play for you. Over the past 6 moths or so, I have been trading Tandem Diabetes (TNDM). I was on a dive trip with one of their engineers back in January. She had many compelling stories about both their leadership team, and technology development process. Their new insulin pump looks to be far superior than anything currently in the pipeline. Initially, it was a high flyer, but faltered, and then screwed the pooch with a reverse-split back in late 2017. From a short-term perspective, it's been a fantastic play. I cashed out my entire position a few weeks ago, but saw that it's down 15% today. My research says long-term, it still looks pretty solid. I'm now considering going long on this. Any thoughts? |

«

Return to Off Topic

|

1 view|%1 views